It promises to be the most compelling battle of ideas in the US stock market this summer.

On one side is one of America’s most popular and widely-followed pickers of tech stocks.

On the other, one of the country’s most respected and influential hedge fund managers.

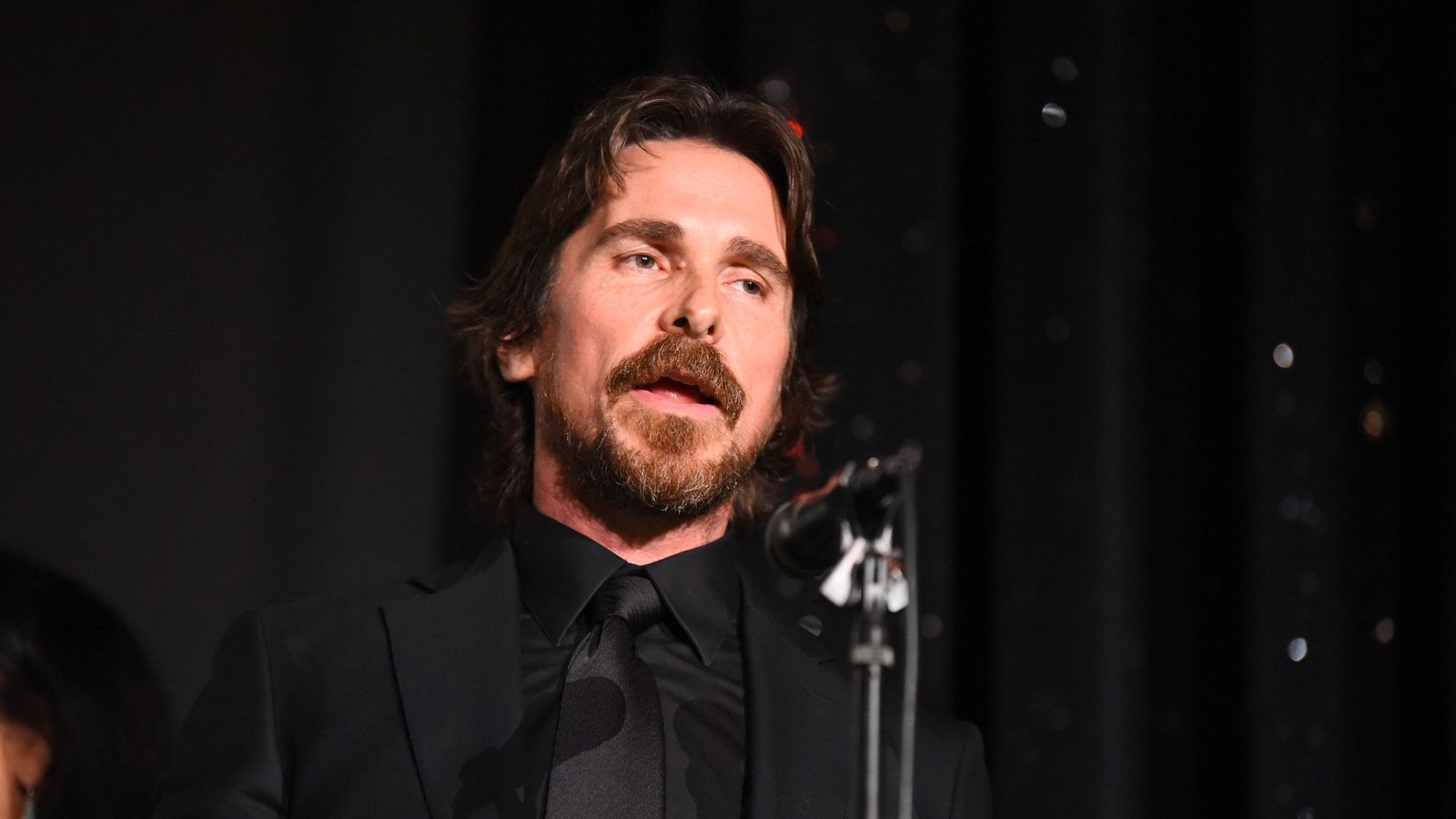

The confrontation emerged on Tuesday when filings revealed that Michael Burry, the hedge fund manager famous for betting on a housing market crash ahead of the financial crisis and portrayed by Christian Bale in the hit film The Big Short, is among investors taking positions against ARK Innovation ETF.

That is the $22.5bn (£16.35bn) flagship fund managed by Cathie Wood, the star investor famous for making bold predictions on tech stocks and whose every move is watched closely by more than one million followers on social media platforms like Twitter and Reddit, where her nicknames include “Queen Cathie”, “Mamma Cathie” and “Cathie Wood BAE” (BAE stands for “Before Anyone Else”).

That following reflects the immense popularity Ms Wood, a devout Catholic whose parents were Irish immigrants, has built due to her remarkable investment performance. The Wall Street Journal reported in February that anyone who had invested $10,000 (£7,300) in ARK Innovation ETF when it was launched, in October 2014, would have seen that grow to more than $78,000 (£56,700), while the same stake in the S&P 500 would have come to less than $22,000 (£16,000). She was one of the earliest institutional investors in both Tesla and in Bitcoin.

As the Journal noted: “Money chases performance. ARK managed a total of $11.4bn at the end of March 2020. By year end, that had swollen to $58.2bn.”

Ms Wood did not hold back once Mr Burry’s bet, which to date totals $31m (£22.5m), became known.

She posted a thread of tweets in which she explained that, while some investors are bearish towards tech stocks because they have concerns about inflation, she believed “disruptive innovation strategies” would once again be rewarded once concerns over inflation abated.

And she concluded: “To his credit, Michael Burry made a great call based on fundamentals and recognized the calamity brewing in the housing/mortgage market. I do not believe that he understands the fundamentals that are creating explosive growth and investment opportunities in the innovation space.”

The disagreement between the pair goes to the heart of the debate that has gripped US stock market investors since the spring – which is whether the rise in US inflation this year is “transitory”, in the words of the Federal Reserve, or something more permanent.

After a stupendous 2020, during which Apple, Amazon and Tesla – a favourite of Ms Wood – were among the best-performing 20 stocks in the S&P 500, tech companies have found the going tougher this year as some investors switched from so-called “growth” stocks towards so-called “cyclical” stocks reckoned to have better prospects as the economy emerged from lockdown.

Expectations of rising inflation and of the higher interest rates that would be needed to tackle it also mean investors have put a lower valuation on the expected future cash flows of tech companies and growth stocks – the key determinant of a company’s share price.

That switch in sentiment has favoured companies such as Simon Property, a shopping mall operator, Robert Half, the recruitment and staffing giant, oil companies like Devon Energy and Marathon Oil, banks such as Wells Fargo, Goldman Sachs and Morgan Stanley and some retailers, such as Bath & Body Works. By contrast, the big tech companies have missed out, partly reflecting concerns that they were already highly valued. For example, Apple is up by just 13% since the beginning of the year, while Tesla is actually down by nearly 6% and Amazon by 0.5%. The S&P 500 itself is up by 18.5% so far this year.

ARK Innovation ETF is itself down some 6% since the beginning of the year and has seen outflows of $500m (£363m) during the last month alone as some investors have taken out their money.

Adding to the fascination of the debate is that not only is Mr Burry betting against Ms Wood’s fund, he is also arguing with some of her specific investment choices.

For example, he has taken out a bet worth some $731m (£531m) on a fall in shares of Tesla, warning the electric vehicle maker’s shareholders in January: “Enjoy it while it lasts.”

Mr Burry is also a sceptic on cryptocurrencies, in which he has predicted the “mother of all crashes”.

He tweeted in June: “When crypto falls from trillions or meme stocks fall from tens of billions, #Mainstreet losses will approach the size of countries. History ain’t changed.

“If you don’t know how much leverage is in crypto, you don’t know anything about crypto, no matter how much else you think you know.”

That scepticism, again, is underpinned by a belief that higher inflation is coming.

Mr Burry’s timing, though, can sometimes be out. His more apocalyptic predictions on crypto have yet to come true.

And, while he was the first big-name investor to take a position in the bombed-out computer gamers retailer GameStop, he missed out on the surge in shares in the business that his own investment helped trigger. He later described the rampant spike in the company’s share price as “unnatural, insane and dangerous”.

So this is a compelling divergence of opinion between two of America’s most renowned investors.

Ms Wood argues that tech and “innovation” stocks are already starting to bring inflation under control again. Mr Burry, who made an estimated $300m (£218m) fortune in identifying the US housing bubble, believes supply bottlenecks and rises in commodity prices already seen this year point to something more deep-seated.

They can’t both be right.