The UK government is under pressure from campaigners and opposition politicians to provide relief on rising energy bills.

Proposals include removing VAT on bills for a year and a windfall tax on North Sea oil and gas producers.

However, cutting the value-added tax won’t “touch the sides” for consumers, says Adam Scorer, chief executive of campaign group National Energy Action, as the tax only makes a small proportion of the overall bill.

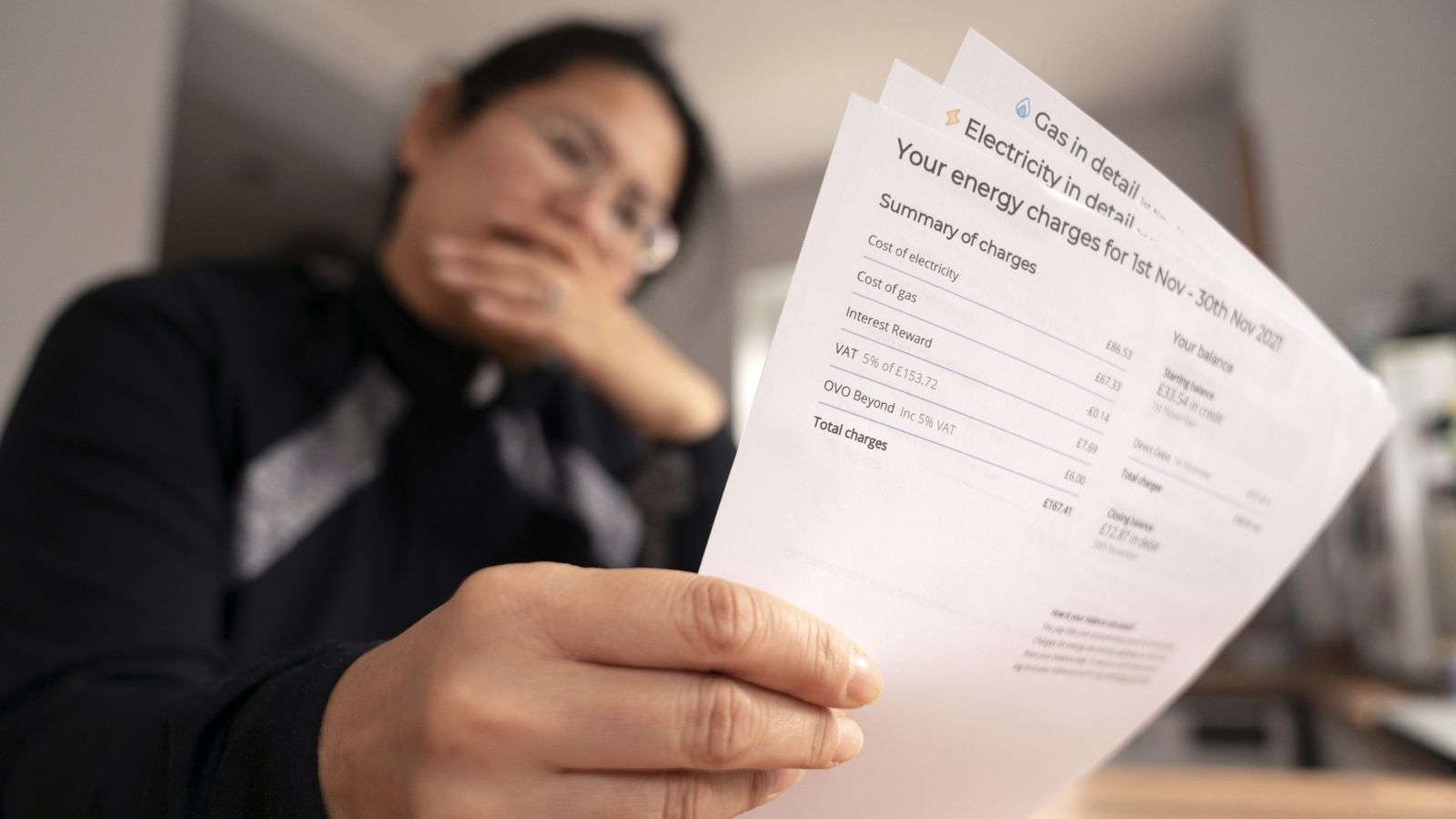

Most recent data from Ofgem, which does not include the surge in electric and gas prices, shows that VAT was around 5% of a typical dual fuel bill.

That means in 2020, VAT was £56 on an annual bill of about £1,200. But as energy prices rise, VAT will also increase as a proportion of the bill.

Today, wholesale natural gas is still three times its pre-pandemic price despite the drop from unprecedented levels over the past month.

National Energy Action says it expects energy suppliers to raise bills by £600 to £800 in April when companies pass on the rise in wholesale costs to consumers.

North Sea gas: Government balancing on environmental tightrope as Shell plans drilling in Jackdaw field

Anger as energy company advises star jumps and cuddling a pet to keep warm this winter

Warrington Council-backed Together Energy lines up administrators

Energy suppliers also pay for “network costs” to gas pipe and electricity cable companies that carry energy across the country into your home. These charges vary over time but are unlikely to be volatile.

Larger energy suppliers also pay for government policies through the “environmental and social obligations” component in our bills.

According to Ofgem, these costs cover schemes for insulation, help vulnerable people and “encourage take-up of renewable technology”.

Twenty Conservative MPs and peers, writing in The Daily Telegraph earlier this year, said suspending green levies could provide relief to consumers as they’re “25% of everybody’s energy bill.”