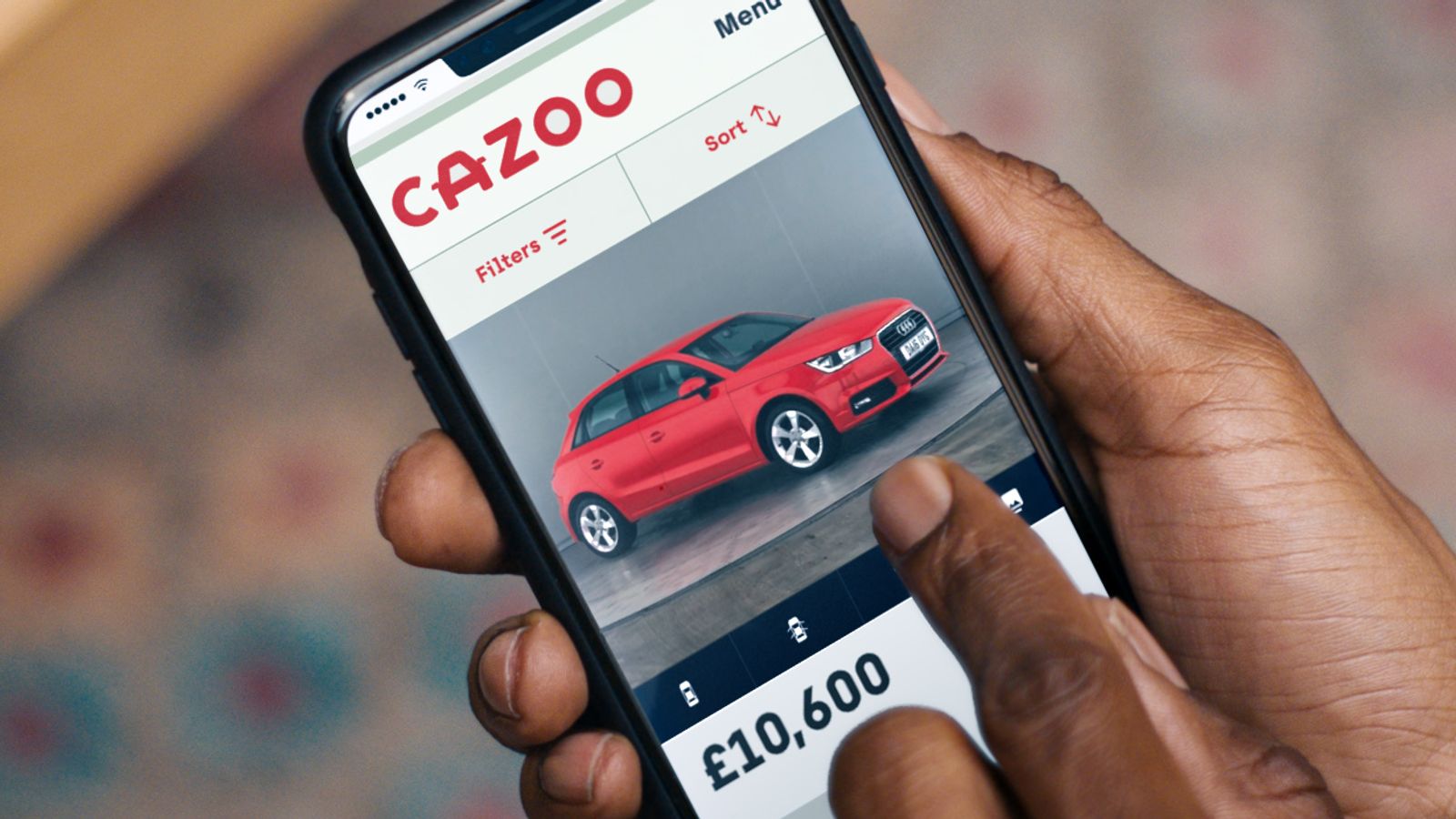

British online used car seller Cazoo is to list on Wall Street in a deal valuing it at $7bn (£5bn) just over a year after its launch.

The company, founded by entrepreneur Alex Chesterman, has agreed to go public via a merger with a so-called “blank cheque” company in New York led by billionaire US investor Dan Och.

Mr Chesterman – who previously founded DVD rental firm Lovefilm and property website Zoopla – will see his 30% stake in Cazoo valued at around £1.5bn under the deal.

Newspaper publisher Daily Mail & General Trust (DMGT), which owns a 20% chunk of the business, also received a boost, with its shares rising as much as 8% on the announcement.

The deal – confirming a story first reported by Sky News – underlines the shift to online vehicle sales during the pandemic.

Mr Chesterman said: “We think, in markets like ours, that shift is permanent because consumers are discovering new ways to transact which are better.”

London-based Cazoo was founded in 2018 and began operating in December 2019. It has built its brand aggressively via sponsorship deals with the likes of Aston Villa and Everton football clubs.

The business, which is currently loss-making, offers online purchases of used vehicles in Britain and continental Europe and has so far delivered more than 20,000.

That is still far smaller than Lookers, a more traditional car dealership group which sold more than 200,000 new and used vehicles in 2019 yet is valued at just over £200m on the stock market.

But Cazoo describes the estimated £500bn-worth European used car sector as “ripe for digital transformation” with less than 2% of it currently online.

The company also foresees rapid growth, with revenues for 2021 expected to approach £700m, up from an estimated £162m last year.

Cazoo now employs more than 1,800 people across the UK, Germany, France and Portugal.

In a presentation to investors it said most consumers were now prepared to buy used cars online – a marked shift from before the pandemic when only a minority said they would.

Cazoo said that traditional dealerships, with their high fixed costs and limited online presence, had been “permanently impaired”.

The company, which made an operating loss of around £88m last year, expects to slip further into the red this year before moving into profit by 2024.

Cazoo’s New York listing will take place via a merger with a so-called special purpose acquisition company (SPAC) called Ajax I led by Mr Och.

SPACs such as Ajax raise funds in a stock float with the aim of then merging with a private company such as Cazoo. It is an alternative to the traditional initial public offering (IPO) route to market.

The deal will provide Cazoo with up to $1.6bn in new funding, which it plans to spend on growing its brand and infrastructure and expanding into new markets such as Italy and Spain.