A US-based buyout firm is leading a pack of bidders to snap up the jewel in the crown of Interserve, which once ranked among the UK’s biggest outsourcing groups.

Sky News has learnt that Platinum Equity has emerged as a leading contender to buy RMD Kwikform, which provides engineering services to major infrastructure projects.

Platinum recently abandoned its interest in the listed pubs chain Marston’s, while it has also withdrawn its interest in a counterbid for Aggreko, the temporary power provider.

Sources said that other private equity firms were interested in RMD Kwikform, Interserve’s profitable equipment services division, and that there was no certainty that Platinum would end up as the buyer.

A deal is likely to value the division at around £150m.

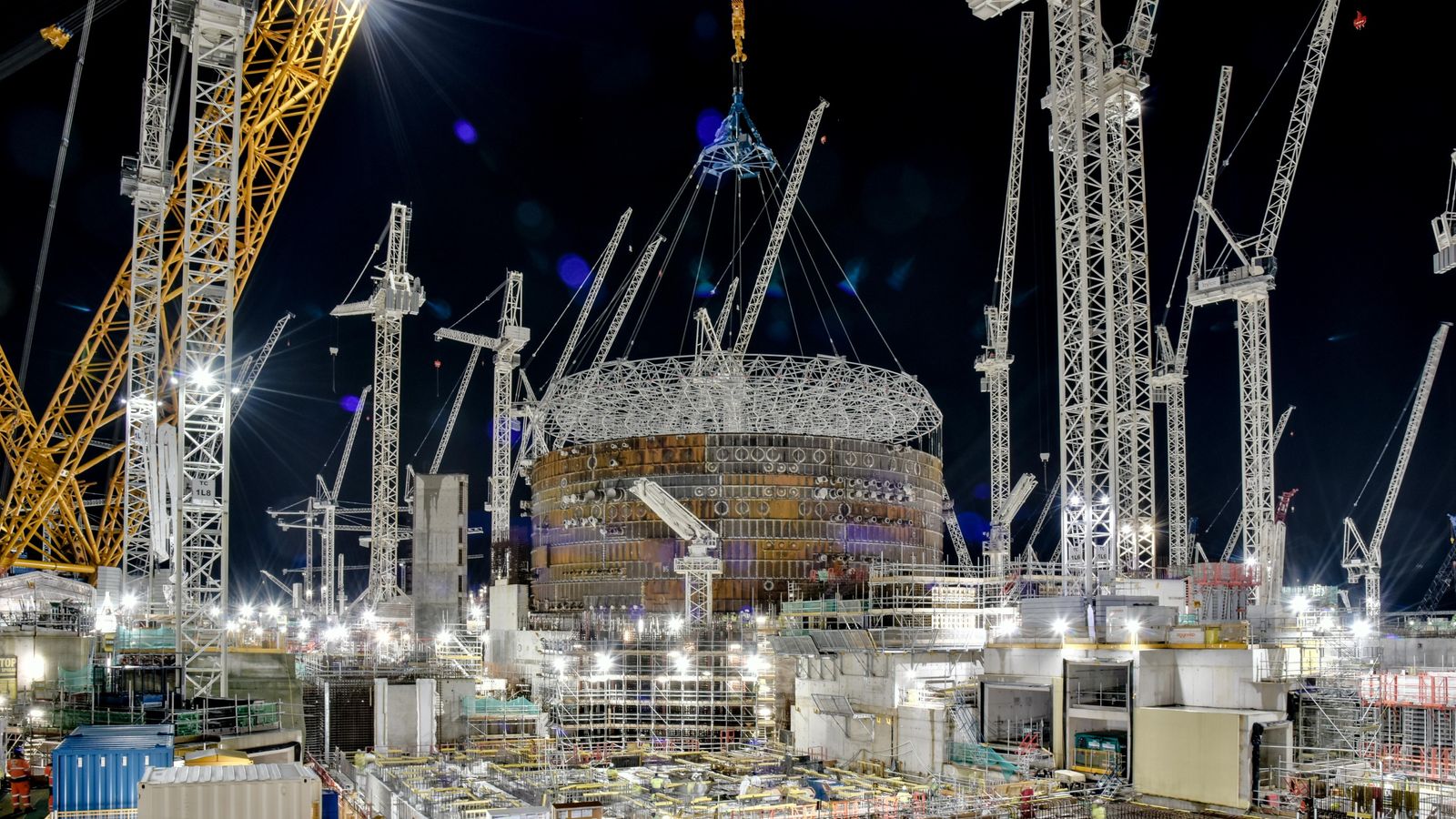

RMD Kwikform has been involved in various stages of construction at HS2, Crossrail, Battersea Power Station and the Hinkley Point nuclear power station.

The division employs about 1,400 people, and is chaired by the City veteran Ken Hanna.

The auction is the second time in five years that Interserve has examined the potential for a sale of the unit.

In 2016, it opted not to offload the unit as the broader group began to run into financial difficulty which ultimately led to its brief collapse into administration.

The group emerged from an insolvency process under the control of funds including Angelo Gordon, Cerberus Capital Management and Davidson Kempner Capital Management.

At its peak, Interserve employed more than 45,000 people in the UK.

Its vast support services arm was subsequently sold to rival Mitie.

Interserve declined to comment, while Platinum did not respond to a request for comment.