For a company often hailed for its forward thinking and for the big bets it places on future business trends, Softbank seems at times to be terribly accident-prone.

The much-heralded tech investor, best known in Britain for its takeover of the chip designer ARM Holdings shortly after the Brexit vote, blundered two years ago with a huge bet on the shared office provider WeWork.

It reported a loss of £5bn in the three months to the end of September 2019 after writing down the value of its investment in the company by $3.4bn, which dragged into a loss the Vision Fund, the giant Saudi-backed investment vehicle through which it has backed businesses such as Uber.

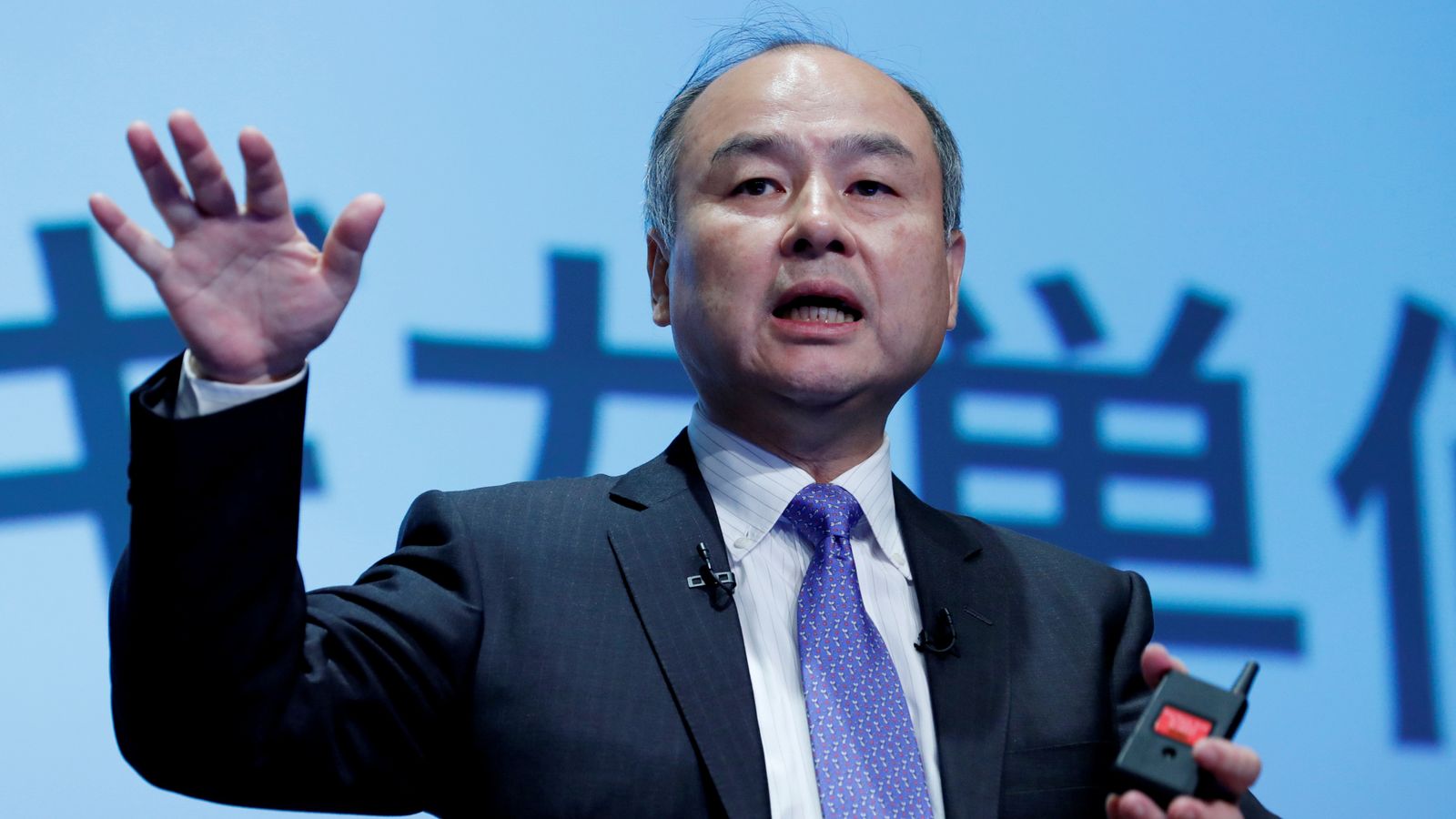

That brought a public apology from Masayoshi Son, Softbank’s founder and chief executive, who is generally regarded as the world’s most influential tech investor.

Today, almost exactly two years on, Mr Son was again explaining a torrent of red ink all over the accounts.

Softbank reported a net loss of ¥397.9bn (£2.6bn) after the Vision Fund reported a quarterly loss of ¥825.1bn (£5.4bn) – the biggest quarterly loss of its history and its first quarterly loss since the first three months of last year.

Once again, the loss reflected write-downs in the value of assets, to the tune of almost £40bn.

JD Sports says car park meeting not suspicious after footage published

Tesla shares fall after Elon Musk’s plan to offload 10% of his stock is backed by Twitter users

Wealth manager Succession joins industry deal rush with £400m sale plan

This time, though, the write-downs were in China rather than the United States.

Softbank appears to have fallen foul of the crackdown on tech companies and tech entrepreneurs launched earlier this year by the Chinese government.

Particularly damaging in this regard was Didi, the Chinese ride-hailing app, which plunged in value just days after its flotation on the New York Stock Exchange after Beijing ordered it to stop registering new drivers and users for its app. Softbank now values its holding in Didi, bought for $12bn, at just $7.5bn.

Another write-down was in the value of Alibaba, the Chinese e-commerce titan, whose valuation fell by around a third. The company has been under pressure since, shortly after announcing plans to float its online finance arm Ant Group, it was singled out by regulators.

The IPO was scuppered in November last year and Alibaba’s previously high-profile founder, Jack Ma, disappeared for three months. Alibaba’s share price rallied when Mr Ma resurfaced in January this year, but shares of Alibaba have since fallen sharply.

Not all the write-downs were Chinese. The Vision Fund was also scalded by its shareholding in Coupang, a South Korean online retailer, which it now values at $6.7bn less.

Mr Son admitted today that Softbank was, in his words, “in the middle of a blizzard”. But he is not giving up on China.

He told a news conference in Tokyo: “I’m extremely worried about the situation in China, but we continue to see new AI-related companies emerge. We will continue to invest.”

Insisting he was not worried about the situation, he said that the Vision Fund’s exposure to China was “manageable”.

Nonetheless, Mr Son is taking action to try and address the situation. Shares of Softbank are now trading at a 50% discount to their net asset value, crudely speaking, a measure of what shareholders would receive were the company to be broken up and all of its assets sold.

So he is proposing to spend ¥1 trillion (£6.51bn) on buying back up to 15% of the company’s shares over the next year – something grumpy shareholders have been calling for.

He has also slowed down the pace at which the company is investing in the tech sector, telling investors in August the company was in “wait and see mode”.

In the meantime, the Vision Fund has also had some winners, as well as losers.

Among the former are DoorDash, the online food-ordering service, which came to market in December last year and which proved a conspicuous success during lockdown. Others include Delhivery, an Indian logistics firm and Ola, an Indian ride-hailing app, both of which are expected to go public in the near future, crystallising big gains for Softbank. The former is expected to attract a valuation of $5.5bn and the latter one of around $2bn.

Mr Son, who has previously compared Softbank to a goose that lays golden eggs, said today: “While some of the eggs our goose has laid just died, the other golden eggs are shining in splendour.”

Investors have long since got used to Mr Son taking big bets. In the past, these have sometimes paid off.

Mr Son is clearly confident that they can do again in future.

But much may depend on the attitude of the Chinese government for that to happen.