Stock levels in relation to expected sales across the distribution sector reached a new record low this month, according to a key business survey as retailers fret over supplies and staffing as a result of the so-called pingdemic.

The CBI’s latest Distributive Trades Survey showed only a slight slowdown in sales growth during July following the best spurt in almost three years the previous month as the economy benefited from pent-up demand in the wake of easing COVID-19 restrictions.

It also reported the fastest growth in orders since December 2010.

Please use Chrome browser for a more accessible video player

But the survey suggested that orders were likely to slow down despite expectations of sales volumes rising at a faster pace next month.

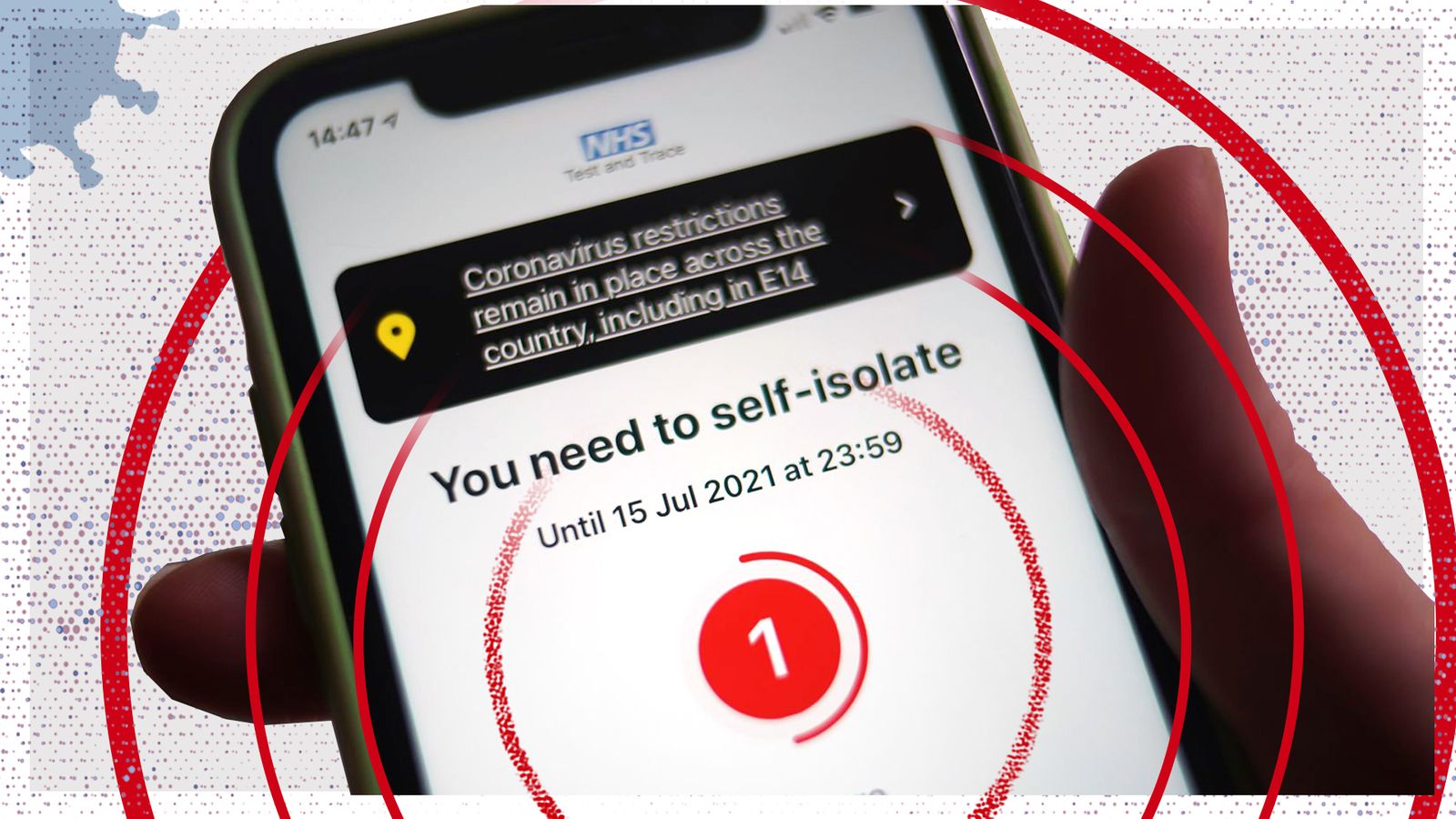

The retail, wholesale and motor trades sectors all reported relative stocks as too low, the CBI said, with the situation expected to deteriorate during August as holidays compound staff shortages – some of them the result of demands to self-isolate when ‘pinged’ by the NHS COVID app.

Government plans to alleviate pandemic-related difficulties in key sectors, including food supply, have been met with business frustration and warnings that they will not result in a quick fix.

Business groups have instead urged ministers to bring forward the date, from 16 August, when people who are double-jabbed in England will no longer have to place themselves in quarantine.

Please use Chrome browser for a more accessible video player

The boss of 2Sisters Food Group, Ranjit Singh Boparan, told Sky News on Monday that difficulties in securing skilled staff in the wake of Brexit had even placed its annual Christmas turkey operation at risk.

The tycoon, who supplies all the major supermarket chains, warned that sporadic shortages on shelves would worsen while many convenience products were on the brink because of growing supply chain lag times.

CBI economist Ben Jones said of the survey’s findings: “Retail sales have been at or above seasonal norms for the last four months now, although this picture is not universal, with the clothing and footwear stores in particular yet to see demand recover to usual levels.

“While demand may be more stable, operational issues worsen.

“Relative stock levels are at a record low and expected to fall further still, while the number one worry for many firms at the minute is labour shortages throughout the supply chain as staff self-isolate.”

The Bank of England is keeping a close eye on whether bottlenecks in supply – such as dwindling stocks in the retail sector – will lead to longer-term inflation pressures.