It’s time to talk about the cost of living, about prices and wages.

Those two things interact and they affect how well off we’re feeling, how much money we have left to spend after our wages and our taxes in the real economy.

Real wages give you a sense of just how much money we have when you’ve adjusted for inflation.

In the years 2000 to 2008, they were rising pretty steadily and if they carried on rising like that, you would have been talking about £600-a-week in real terms.

But instead, they basically flatlined.

They really didn’t rise over the entire period, you had this lost decade of growth, the biggest squeeze we’ve ever seen.

More recently, there is a glimmer of light because there has been a bit of an increase, but the question is whether that’s primarily down to COVID and whether it actually endures.

COVID-19: ‘Do what is morally right’ – WHO sets target of vaccinating 70% of world by mid-2022

COVID-19: Travel red list countries slashed to seven as 47 destinations to be removed

COVID-19: World Health Organisation ships essential medical supplies to North Korea

You’ve got a lot of things that are interacting here, higher wages but also now higher inflation.

The wholesale gas prices that we pay in the UK are at the highest level we have ever seen.

They have come down a little bit just in the last week or so, but nonetheless incredibly high – that’s feeding into all of our bills.

As are the global prices for a few important things.

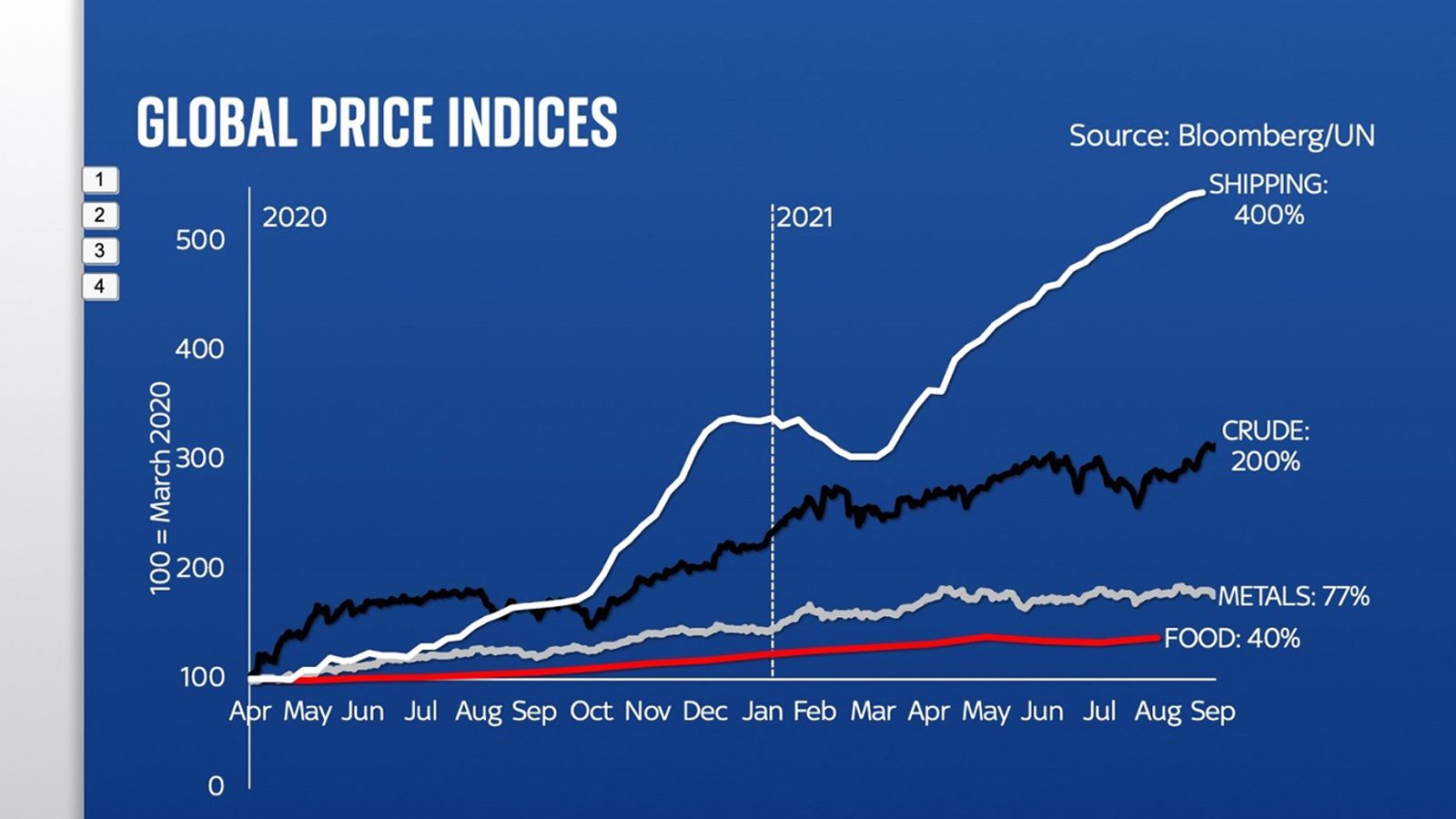

Metals are up by 77% since COVID-19 struck, crude oil prices are up 200% since COVID, and food prices have increased by 40% – which in any given period would be considered very high.

Overall shipping prices are up by 400% – so there is a lot of talk about lorry drivers, about the difficulty of getting things from one place to another in this country, but it is a global situation.

It is feeding into all of our prices and it’s pushing up inflation.

The Bank of England says that CPI inflation, which is the annual rate at which prices are rising, shouldn’t get too high but they have previously said it was not going to go beyond 3.3%.

However, it went higher and now it’s saying it is going to go above 4%.

So a lot of people wonder whether inflation is back and we will be keeping an eye on that in the coming months.