An online chemist which has become the NHS’s biggest repeat prescription service is plotting a sale that could reap handsome gains for its private equity backer.

Sky News has learnt that Pharmacy2U, which was established in 1999, has engaged bankers at Lazard to explore strategic options for the business.

City sources said this was likely to lead to a sale to a new private equity backer, although other alternatives are expected to be considered.

Pharmacy2U sold a big stake to G-Square Capital in 2018 in return for a £40m investment, while the Business Growth Fund – which is backed by Britain’s major high street banks – invested £17m in the business in 2016.

According to accounts filed at Companies House, Pharmacy2U has been a big beneficiary of the pandemic, seeing the number of NHS-nominated patients increase to 553,000 from 441,000 just six months earlier.

Its rapid growth on 2019’s performance fuelled a 29% surge in revenue to £78.3m during the year to March 2020.

In its accounts, Pharmacy2U said the national lockdown which began a year ago had prompted such demand for its service that its auditors at BDO “were unable to attend a year-end stock count and have therefore issued a modified audit opinion”.

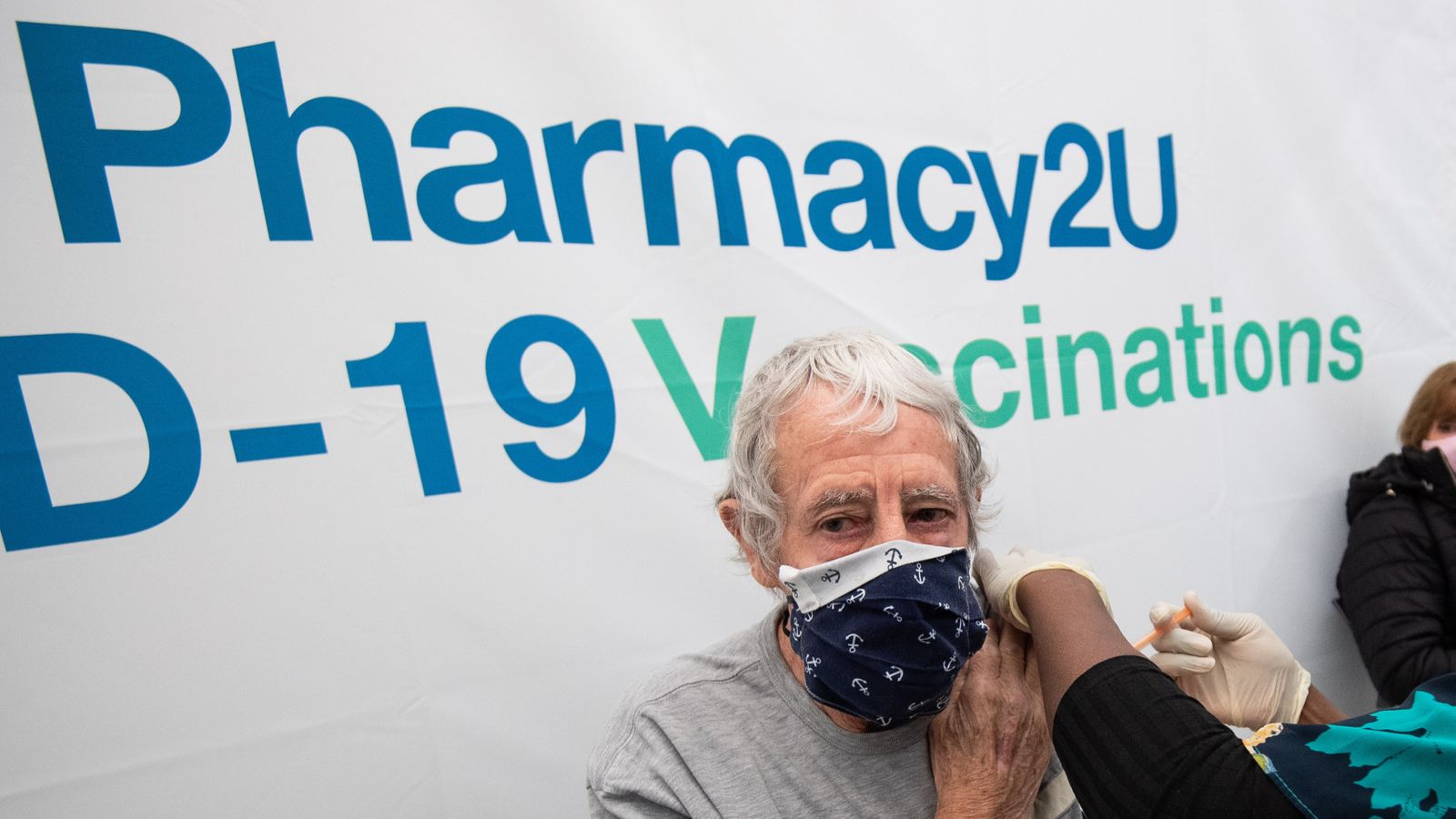

Pharmacy2U’s growth reflects soaring demand for online healthcare services during the coronavirus crisis, even as physical pharmacies have warned about the financial difficulties their industry is facing.

Last month, Sky News revealed that the owner of LloydsPharmacy, McKesson Corporation, has put its UK business up for sale with an estimated asking price of £400m.

A spokesman for Pharmacy2U declined to comment on Lazard’s appointment and refused to answer further questions about the company.