It seems China will have no part in the construction of new nuclear power stations in Britain.

Several seemingly well-briefed stories in the Sunday newspapers last weekend indicated that China General Nuclear (CGN), which currently has a 20% stake in the new Sizewell C plant to be built in Suffolk, is to be removed from the project.

This was followed today by an authoritative report in the Financial Times which suggested CGN’s stake in the new £20bn plant would be sold to institutional investors or even floated on the stock market.

The FT said that, under the plans, the government would hold the stake until it could be sold on to institutional investors – but that an initial public offering was also being examined.

The decision almost certainly means China’s plans to build a new nuclear power plant at Bradwell-on-Sea in Essex, which CGN would fully own, will be scuppered.

The Department of Business had this to say on the FT’s report: “CGN is currently a shareholder in Sizewell C up until the point of the government’s final investment decision.

“Negotiations are ongoing and no final decision has been taken.”

Energy crisis: Igloo joins list of small suppliers on scrap heap as gas prices leap

Pound at eight-month low as ‘stagflation’ crisis fears take hold

Fuel crisis: Business Secretary Kwasi Kwarteng ‘not guaranteeing anything’ over impact on Christmas

But Sir Iain Duncan Smith, the former Conservative leader and co-chair of the Inter-Parliamentary Alliance on China – which called in July for the UK to cancel this contract – has no doubt.

He told Sky News: “I sat as a secretary of state for six years and I know what a non-denial from government looks like – and that’s definitely a non-denial.”

Sir Iain, whose group has campaigned in 21 countries from Japan to the United States to remove China from crucial infrastructure projects, said that taking China out of Bradwell as well as Sizewell was “very important”.

Please use Chrome browser for a more accessible video player

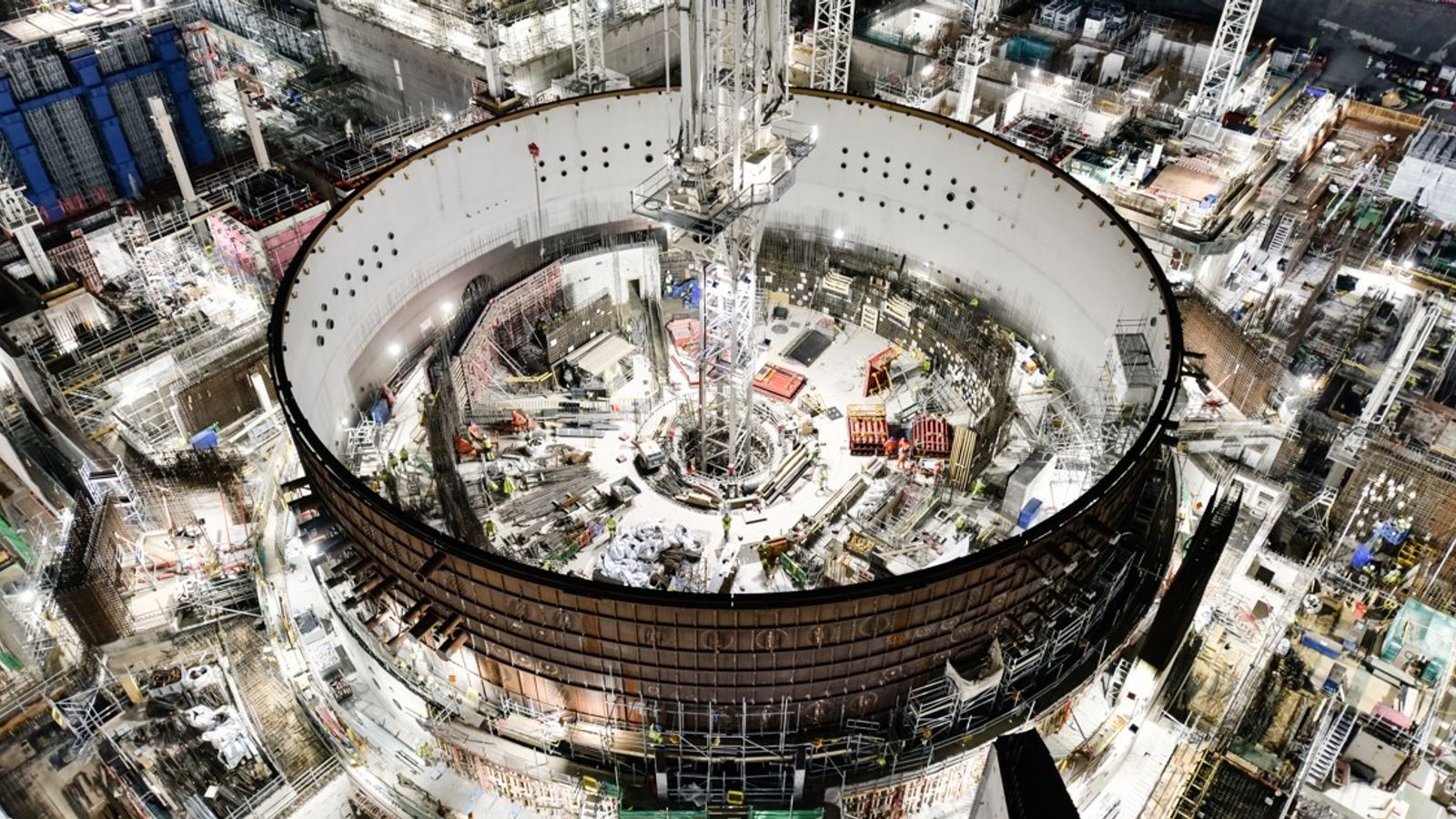

The reason why the government is hesitating to deliver the final coup de grace to CGN’s involvement, though, may because the company is also a major participant in Britain’s first new nuclear power plant in a generation, Hinkley Point C in Somerset, in which it is a minority investor.

The plant is being built by EDF, the French energy giant, but CGN has so far committed some £4bn. It is unlikely to put up more if removed from work at Sizewell and Bradwell.

And that raises a big question – whether other investors will be prepared to put up the money that CGN was prepared to invest in these types of project.

As things stand, EDF is yet to make a final investment decision on Sizewell C. Central to that is not only final planning consent, which was delayed by the pandemic, but also a funding settlement from the government that would, as with Hinkley Point C, enable it to recoup some of its construction costs from household energy bills.

Reaching an agreement on this will not be easy. Failure to do so was why Hitachi of Japan first suspended and then last year walked away from plans to build a new £20bn nuclear power plant at Wylfa Newedd on the island of Anglesey off the coast of north Wales – which would have been enough to meet 6% of the UK’s entire electricity needs.

The government is hoping to revive that project with the US nuclear power group Westinghouse, which was owned by the old British Nuclear Fuels from 1999 to 2005, along with the construction giant Bechtel.

There are not, however, legions of foreign investors queueing up to invest in new nuclear build in Britain.

But Sir Iain said he believed institutional investors would be prepared to put up capital to support the construction of Sizewell C.

He suggested the UK government should be ready to put up more money if necessary rather than, as with CGN, simply going for the lowest-cost option: “Hitachi would have been perfectly okay to do this project with us but the reality was, for them, the numbers didn’t add up because the British government was likely to take the cheapest bidder.

“We’ve got to stop that now – what we’ve got to look at is the most sustainable and secure bidder for these really important stations.”

There is certainly no doubt the recent surge in wholesale energy prices has focused the minds of ministers on the need for nuclear to play a greater part in the UK’s energy mix, particularly in replacing gas as a back-up source of energy when renewables are unable to meet power demand, for example when the wind does not blow.

Sir Iain said this was an opportunity to attract greater investment.

He added: “If nothing has told us more about the problems we have with energy supply [than the recent crisis] it tells us critically that, as we head to net zero, we need to understand the true cost of that – and one of the areas that we need to invest in is nuclear energy. Successive governments have shelved any decisions which has left us with a whole bunch of power stations about to close and not enough opening up.

“So I think anybody who wants to invest their money would see straight away that nuclear is very much the coming power generator and the government will probably, if necessary, take on this stake themselves and then sell it once they find a reasonable buyer.

“But I think it’s the right thing to do – we cannot have things so important to us, that are strategic really, in the hands of a government that frankly behaves in an intolerable, bullying and despotic manner.”

Yet there are also signs that ministers may be thinking about new nuclear build not in terms of landmark infrastructure projects like Hinkley Point C but more in terms of the small modular reactors on which Rolls-Royce and its partners, including the construction firm Laing O’Rourke, are working.

Rolls and its partners believe constructing 16 such reactors around the UK, mainly on the sites of existing new nuclear power plants, could create 40,000 jobs, mainly across the midlands and the north of England.

As it pursues its so-called ‘levelling up’ agenda, the government may find that prospect irresistible.