Big Short investor Michael Burry’s investment vehicle has disclosed a $534m bet against Tesla’s stock price.

Scion Asset Management, Mr Burry’s family office, disclosed that it has “put” options on 800,100 shares in the electric car maker.

A put option allows an investor to sell shares at a certain price in the future. Such options can be traded and become more valuable as a share price decreases.

Mr Burry is one of the investors who was profiled in the book “The Big Short” and the film of the same name for betting more than a billion dollars against the US housing bubble.

He has been sceptical of Tesla’s share price surge.

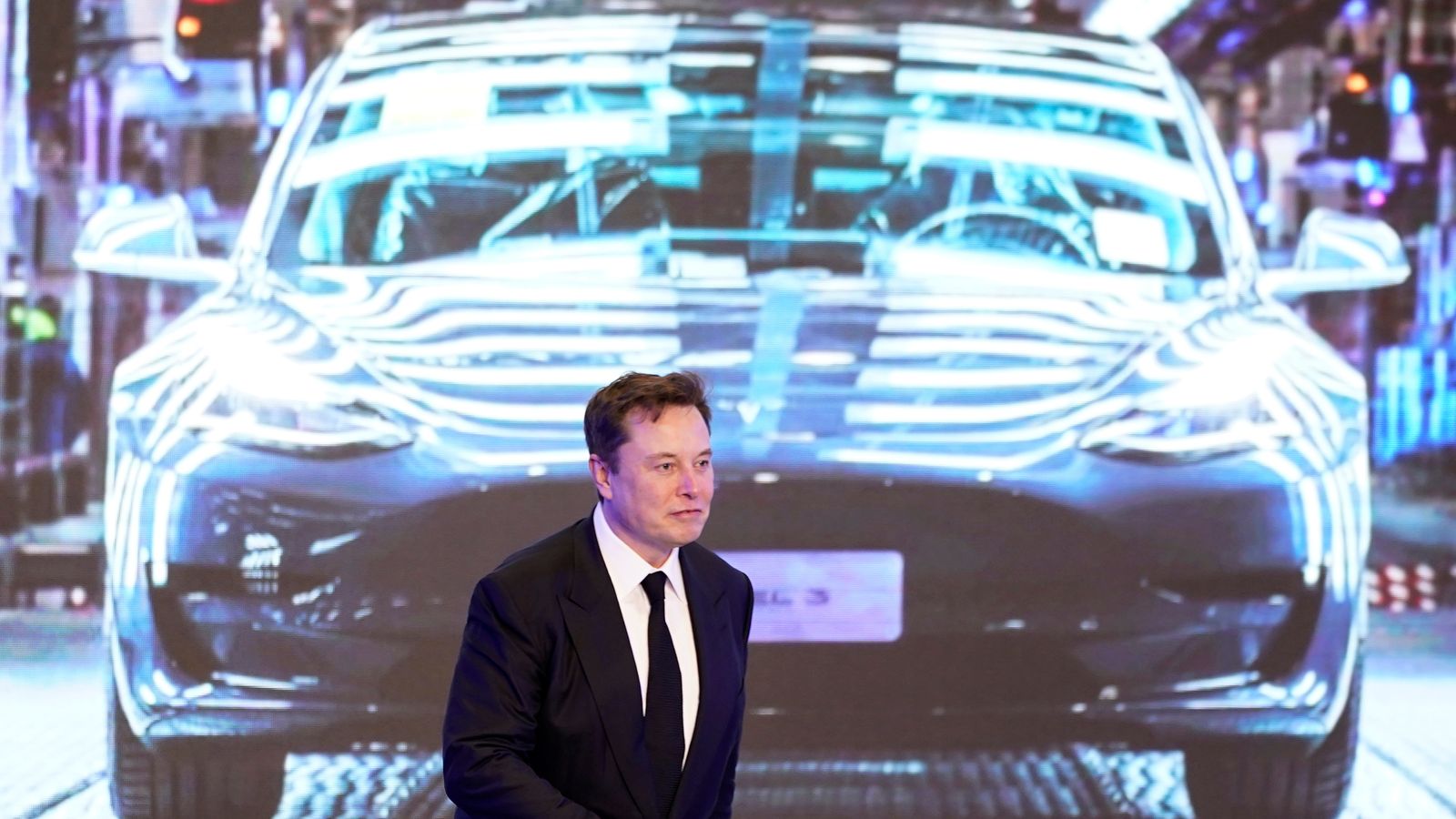

The company, led by Elon Musk, saw its valuation jump eight-fold last year and it now dwarfs that of other traditional car makers which produce far more vehicles.

In February, Mr Burry tweeted about the latest share price surge: “Enjoy it while it lasts.”

Tesla’s shares hit a record $883 in January but have since fallen back and closed at $576 on Monday.

Its value has been buoyed by higher sales and its first ever annual profit.

But much of that profit came from the sale of green regulatory credits – which Tesla has been able to sell to traditional carmakers to help them achieve emissions targets.

Stellantis – the car giant formed from the merger between Fiat Chrysler and Peugeot and Vauxhall maker PSA – said this month it expects to achieve its carbon dioxide targets this year without environmental credits bought from Tesla.