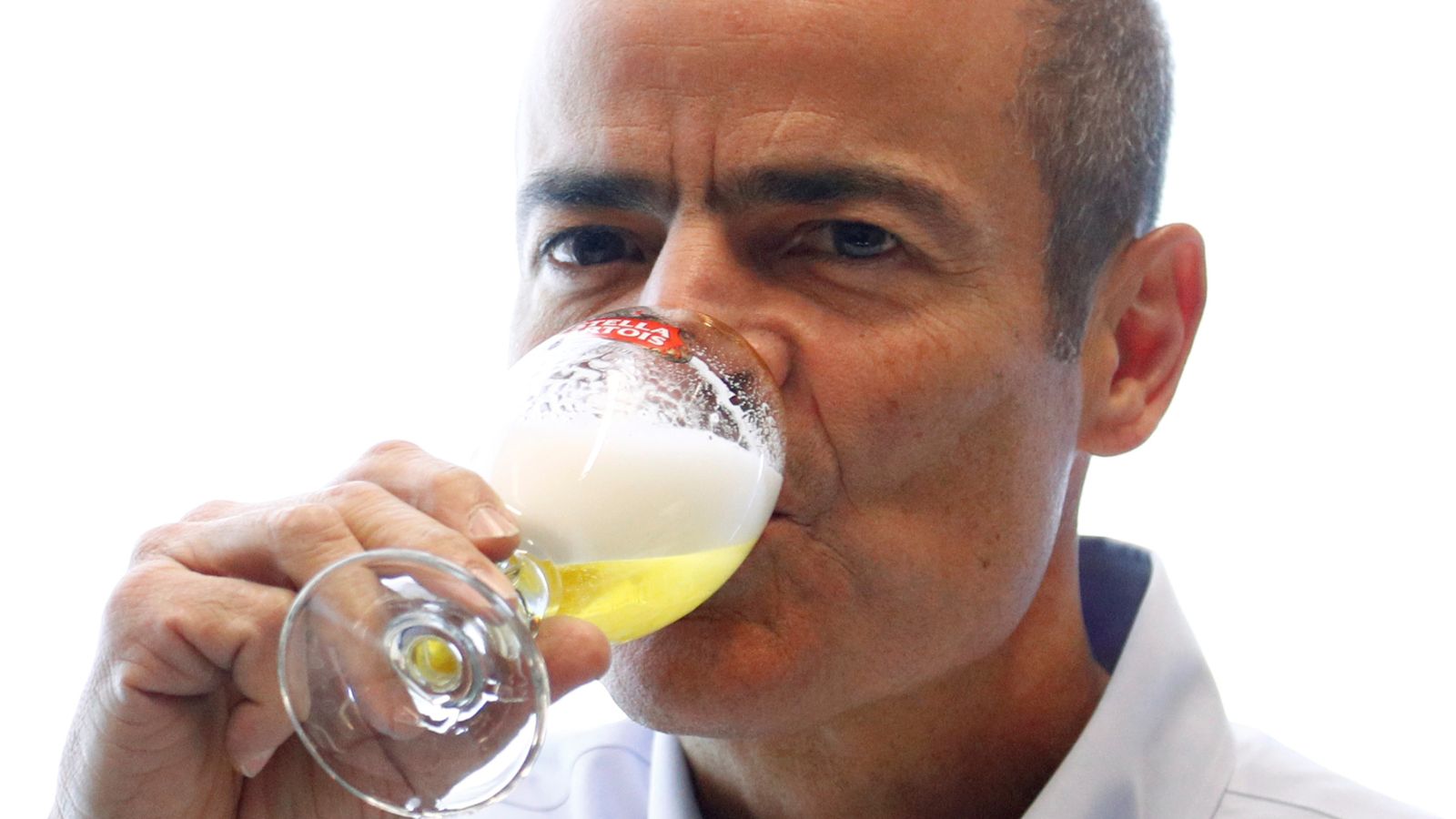

He has had more influence on the global brewing industry than anyone else during the last couple of decades – although it is doubtful most beer drinkers even know who Carlos Brito is.

Today the Brazilian announced he was stepping down as chief executive of AB-InBev, the world’s biggest brewer, which sells one pint in every four swigged worldwide.

The company is a colossus that last year produced 530 million hectolitres of beer – the equivalent of more than 93.2 billion pints.

Its sprawling portfolio of brands includes six of the world’s most valuable beer brands – Budweiser, Stella Artois, Bud Light, Corona, Brahma and Modelo – and countless other household names including Becks, Jupiler, Leffe, Lowenbrau, Bass and Boddingtons.

It is a business Mr Brito, who will be 61 on Saturday, effectively created through a series of mergers during 17 years at the top.

He entered the brewing industry when, in 1989, he joined the Brazilian brewer Brahma.

It merged in 1999 with Antarctica, its local rival, to create AmBev – a company dominating the vast Latin American beer market.

This was only the start of a series of deals.

Mr Brito became chief executive of AmBev at the beginning of 2004 and, within months, had unveiled an $11.5bn blockbuster tie-up with Interbrew, the Belgian brewer behind brands such as Stella Artois, Labatts and Rolling Rock.

The deal was presented in Belgium, which is proud of its brewing heritage, as a takeover by Interbrew.

But InBev, the company which emerged, was nonetheless headed by Mr Brito.

Next, in 2008, InBev bought Anheuser-Busch, the maker of Budweiser, for $52bn in cash to cement its position as the world’s biggest brewer.

The company was rechristened AB-InBev.

The global beer industry was rapidly consolidating into just a handful of players for, while InBev was guzzling the parent of Budweiser, Europeans Heineken and Carlsberg were teaming up to take over Britain’s Scottish & Newcastle.

The only company approaching the size of AB-Inbev was London-listed SABMiller.

This was itself a company built up during a decade’s worth of mergers and acquisitions masterminded by its inspirational chief executive, the late Graham Mackay.

Mr Mackay took the old South African Breweries, a company little-known outside its homeland, and made it a global giant with acquisitions of businesses such as Czech-based Pilsner Urquell, US-based Miller Brewing and, in 2011, the Australian brewer Foster’s.

Back at AB-InBev, meanwhile, Mr Brito was pursuing another big takeover in the shape of Modelo, the Mexican brewer, which was snapped up in 2012 in a deal valuing it at $40bn.

By 2014, with some investors wondering how it was going to keep up momentum, AB-InBev was pondering its next acquisition.

With Heineken controlled by the wealthy Heineken family and Carlsberg protected by a trust, it quickly became obvious its likeliest target was SABMiller.

Many in the industry were concerned.

SABMiller was regarded – not least by its own executives – as being run by managers who were passionate about brewing and passionate about preserving a decentralised company structure and a big portfolio of local brands some of which, like Castle in South Africa, were steeped in the values of their local communities.

Culturally, it could not have been more different from AB-InBev, which was characterised as a gigantic acquisition vehicle run by a bunch of financial engineers.

Nonetheless, in 2016, AB-InBev prevailed with a $109bn takeover of SABMiller.

The deal made it more than four times the size of Heineken, its nearest competitor.

This time, though, investors wondered whether Mr Brito had bitten off more than he could chew.

The deal saddled AB-InBev with more than $100bn of debt and numerous SABMiller brands were sold to reduce borrowings, most notably Peroni Nastro Azzurro, Grolsch and Pilsner Urquell, which were bought by Asahi of Japan

At the same time, alarmingly, AB-InBev’s sales growth slammed into reverse as millions of drinkers around the world switched from established brands to craft beers – a trend Mr Brito has been accused of being slow to pick up on.

In April 2020, as the world was going into lockdown, AB-InBev halved its dividend pay-out.

Mr Brito’s mentor throughout has been Jorge Paulo Lemann, a Brazilian-Swiss billionaire and former Brazilian national tennis champion, who played at Wimbledon in 1962.

The private equity firm he founded, 3G Capital, backed the merger of AmBev and Interbrew and has been influential in every deal the company has done since.

It also owned Burger King for a while and was instrumental in the 2015 merger of the US food giants Kraft and Heinz.

The combined Kraft-Heinz then shocked the food industry by making a takeover approach to Unilever, a company twice its size, which was beaten off amid concerns about widespread cost-cutting.

Mr Brito became Mr Lemann’s protégé when he was accepted for a place on the MBA programme at the prestigious Stanford University Business School – but realised he could not afford the tuition fees.

A friend arranged a meeting with Mr Lemann who agreed to support Mr Brito’s education on the basis that he provided him with regular updates on his progress and that, when he could afford to do so, he promised to provide similar support to others.

Throughout his career, Mr Brito has adhered to 3G’s mantra – relentless cost-cutting, restructuring and zero-based budgeting, where executives begin each financial year – or in some cases each quarter – with a blank sheet of paper on which they are obliged to spell out and justify any spending they wish to carry out.

It has made him and 3G’s backers – who have parleyed their original $250m stake in Brahma into a shareholding in AB-InBev worth $31bn at its peak – spectacularly wealthy.

But it has also left them open to criticism, as seen ahead of the SABMiller deal, that they are little more than cost-cutters.

Those concerns have intensified in recent years as AB-InBev’s growth has stuttered.

Some investors have worried whether a management team obsessed with cost-cutting is equipped to focus on organic growth – which, now AB-InBev has run out of acquisition targets, is going to be of increased importance.

It has not helped, in an industry packed with executives who love their product, that Mr Brito has often appeared more passionate about cost-cutting than beer.

Interviewers have even struggled at times to get him to name his favourite beer – although he has since admitted it is Budweiser, something he shares with his successor, AB-InBev’s North American chief Michel Doukeris.

AB-InBev, whose brands include Goose Island and Camden Pale Ale, is now one of the world’s biggest players in craft beer but the category still accounts for only 1% of its sales and Mr Brito himself has admitted in the past that the company needs to be communicating its position in the field more effectively.

In Britain, meanwhile, drinkers of a certain age remain resentful of AB-InBev’s refusal to invest meaningfully in Bass Ale, once the UK’s biggest-selling beer, or sell the brand to a new owner that would.

Not that Mr Brito will be too worried about that.

The boy who was educated for 12 years by Jesuits and whose hair-shirt approach includes wearing a plastic watch and flying business class only on journeys that are more than six hours long has had a dazzling career and enough money in the bank not to worry where the next beer will come from.