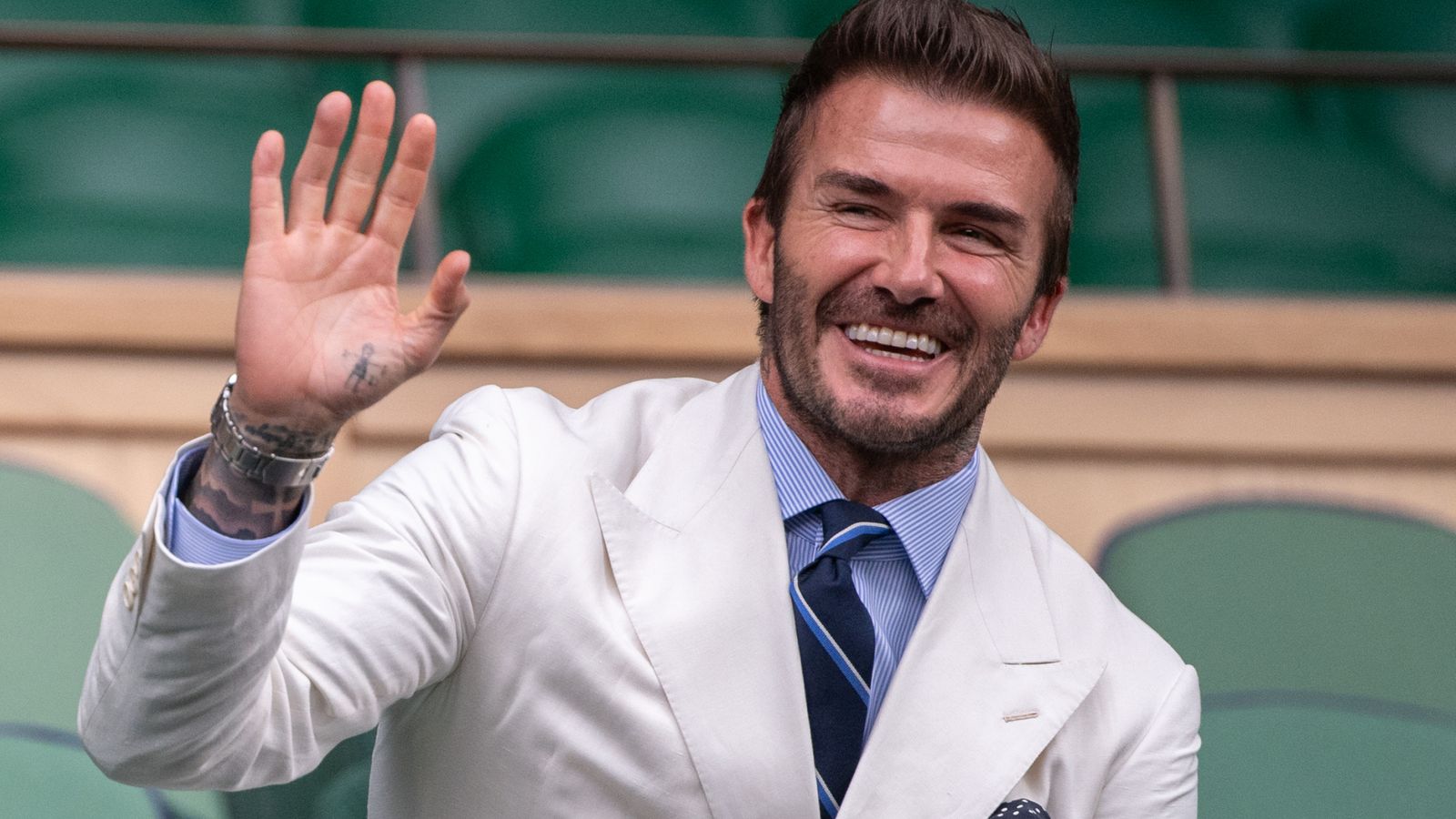

David Beckham’s management company is in talks to buy out the former England captain’s consumer products licensing joint venture, a move that would give him greater control of a lucrative array of commercial endorsements.

Sky News has learnt that David Beckham Ventures Limited (DBVL) is in the early stages of negotiations with Global Brands Group (GBG), a Hong Kong-listed company, to take full or majority ownership of Seven Global.

The discussions are at an early stage and only got under way in the last week, according to people close to the situation.

Sources suggested that acquiring GBG’s stake in Seven Global could cost Beckham in the region of $40m (£28.8m), although a more precise figure was unclear on Wednesday.

Seven Global was established in 2015 and assumed control of some of Beckham’s longest-running commercial partnerships, including those with the sportswear label Adidas and Tudor, a watch brand owned by Rolex.

The joint venture, in which DVBL is understood to hold a 49% stake, also includes the former footballer’s partnerships with the eyewear maker Safilo, the fragrances producer Coty and in categories such as skincare.

It was created in the wake of Beckham’s long-standing commercial management relationship with Simon Fuller’s XIX Entertainment.

In 2019, the former Manchester United and Real Madrid player was reported to have paid around $50m to buy out XIX’s stake in his brand company.

Reports earlier this year said that Beckham and his wife, the fashion designer and former pop singer Victoria, paid themselves more than £20m in dividends from DBVL in 2019 and 2020.

Seven Global is understood to be one of the major profit centres for GBG, which develops products under owned and licensed brands such as AllSaints, Calvin Klein, Juice Couture and Reiss.

A full buyout of Seven Global would be the latest big commercial move for Beckham, whose global appeal has continued to grow after more than a decade since his retirement as a professional footballer.

His other brand partners include the alcoholic drinks manufacturer Diageo and the casino operator, Las Vegas Sands.

Beckham’s portfolio of commercial deals has made him one of the world’s wealthiest former sportsmen.

He recently acquired stakes in Lunaz, an electrified classic car venture, and Cellular Goods, a manufacturer of consumer products made from synthetic cannabinoids.

On Wednesday, Guild Esports, a franchise backed by Beckham, announced that its executive chairman had resigned suddenly, sending its shares down by more than 8% in early afternoon trading.

The talks between DBVL and GBG come at a difficult time for the Hong Kong-listed brand licensing powerhouse.

Sources said that advisory firms including Alvarez & Marsal, Ankura and Teneo were being lined up to oversee a potential restructuring of the company following a sharp drop in revenues during the pandemic.

GBG’s lenders are understood to be keen to initiate formal talks about a deal.

The group has a separate joint venture with Creative Artists Agency, the talent manager, which it describes as the world’s largest brand management company.

DBVL declined to comment, while GBG could not be reached for comment.