A commission-free retail investment platform which has seen trading activity surge during the pandemic will this week complete its biggest fundraising to date comprising a syndicate of blue-chip investors.

Sky News has learnt that Freetrade is to announce as soon as Tuesday that it has raised £50m from funds led by Left Lane Capital, a US-based investor in consumer internet businesses and a former backer of Hello Fresh and N26, the digital bank.

The round will also bring in the growth fund of L Catterton, a private equity firm which is affiliated to the LVMH luxury goods dynasty headed by Bernard Arnault, one of the world’s wealthiest people.

Sources said on Monday that the funding round comprised roughly £35m of new shares, with the remainder made up of sales by existing Freetrade investors.

The capital injection comes as Freetrade’s growth continues to surge.

It now has roughly 600,000 customers, has exceeded £1bn in quarterly trading volumes, and is expanding into Australia and Sweden.

Founded three years ago by chief executive Adam Dodds and Viktor Nebehaj, its chief marketing officer, Freetrade competes with larger rivals such as Hargreaves Lansdown and Interactive Investor of the UK and Robinhood, the US-based platform.

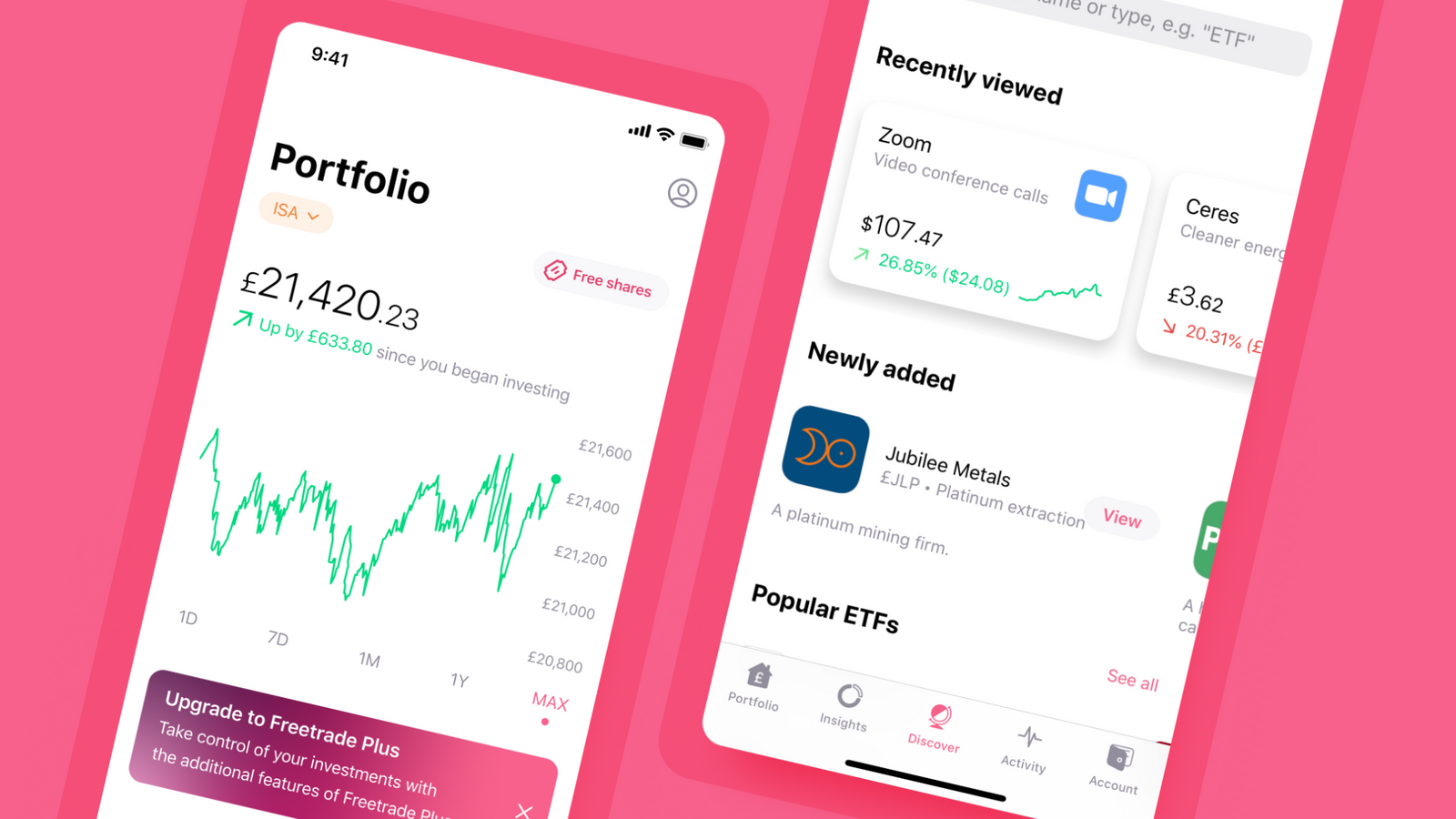

Unlike competitors, Freetrade operates what it calls a ‘freemium’ model which charges monthly subscription fees for a premium account, a stocks and shares ISA and a Self-Invested Personal Pension.

It does not charge commission on individual trades or offer complex, leveraged products, which it has argued “serve little purpose in long-term portfolios, encourage speculative behaviour and can result in significant losses”.

Please use Chrome browser for a more accessible video player

Instead, Freetrade also charges a fee of 45 basis points on transactions in foreign currency-denominated shares, although it argues that this is substantially lower than those charged by retail brokers.

The company has said that because its fee structure is transparent and low-cost, it can entice more consumers into investing even when they have smaller sums of money available to do so.

Freetrade previously raised roughly £30m from a number of crowdfunding exercises and a Series A round in 2019 led by Draper Esprit, the London-listed venture investor.

In recent years, a number of low-cost trading platforms have emerged across Europe, such as TradeRepublic in Germany, in an attempt to capture market share.

Freetrade declined to comment on Monday.