For the first time in more than a year, fund managers do not see COVID-19 as the biggest risk for global markets to grapple with.

That is the eye-catching finding of the latest monthly survey of fund managers carried out by the investment banking arm of Bank of America (BoA).

Every month, since February last year, those participating in this influential survey have pinpointed coronavirus as the number one concern.

The latest survey, conducted among market professionals managing $597bn (£430bn) worth of money, has it as only the third biggest concern.

Please use Chrome browser for a more accessible video player

Instead, weighing more heavily on the minds of investors is higher-than-expected inflation, identified as the biggest single concern by 37% of those polled.

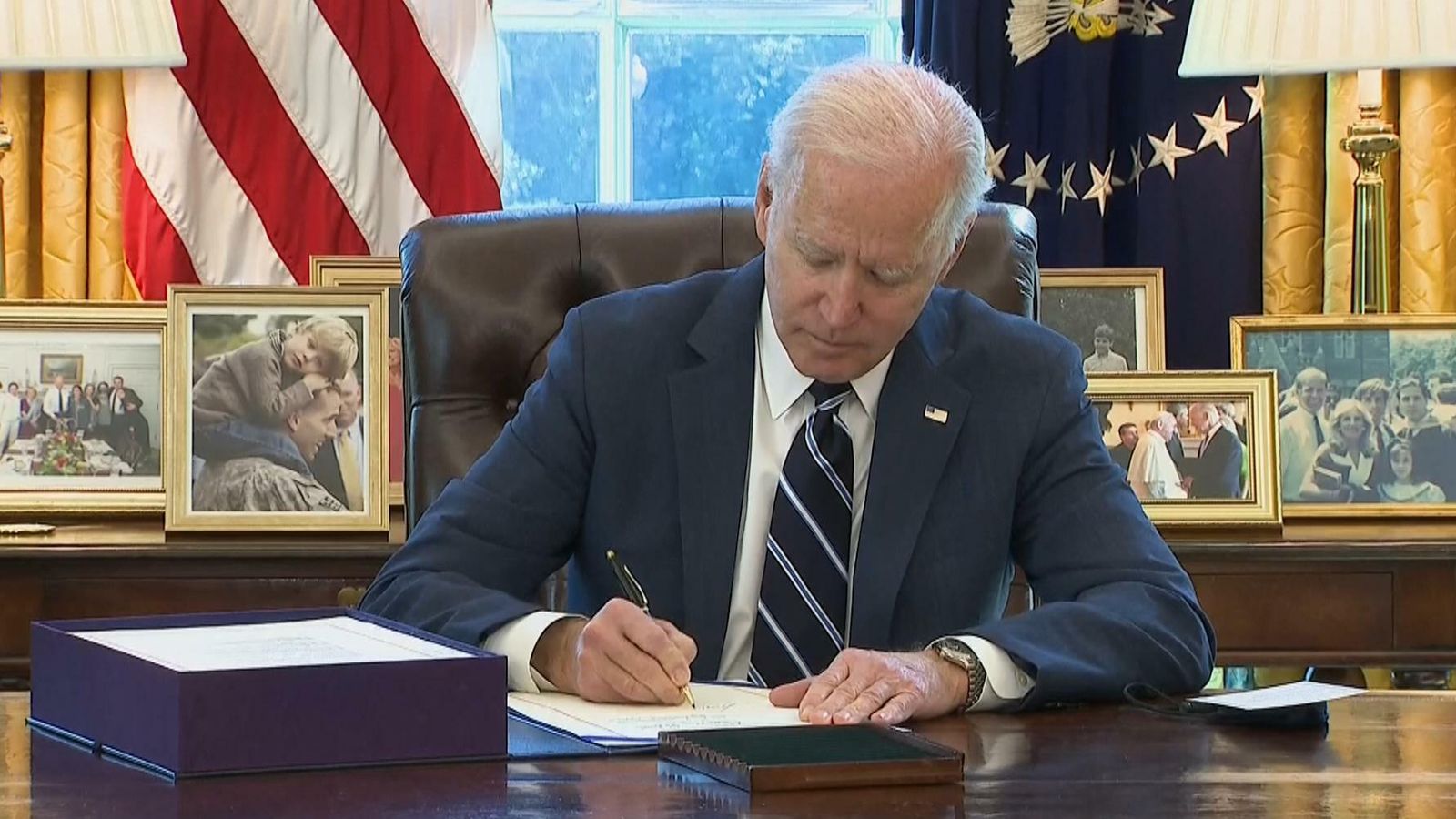

This is perhaps understandable. Joe Biden has just signed into law a $1.9trn stimulus package as he seeks to promote growth in the US economy as it emerges from the pandemic.

This is on top of the $900bn stimulus package that the Trump administration unveiled in its dying days.

It has raised concerns that the US economy, which contracted during the pandemic by less than that of Japan or of major European economies such as Germany, the UK and France, may over-heat – with the supply of goods and services failing to keep up with demand.

This was the reason for the recent sell-off in US government bonds, or Treasuries, as inflation is the enemy of fixed-income securities.

The yield – which rises as the price falls – on 10-year US Treasuries hit 1.642% on Friday last week, its highest level since February last year and predating the pandemic, having stood at 0.912% at the beginning of the year.

That is a big jump. To put it in context, the yield on 10-year UK government gilts currently stands at 0.781%, while the yield on 10-year Japanese government bonds, JGBs, is currently 0.1%.

The yield on 10-year Bunds, German government bonds, is currently -0.344% – in other words, continuing an established trend in recent years of investors actually paying the German government for the right to lend to it.

So the rise in US Treasury yields highlights the extent to which investors are demanding a premium for lending to Uncle Sam.

That is not of itself a concern to the US government when the US Federal Reserve is buying in $120bn worth of assets each month – a good deal of that in the form of US Treasuries – as it continues with Quantitative Easing (QE).

But the speed with which the Fed may withdraw those purchases, if it suspects that the US economy is running too hot or if inflation is about to rear its ugly head, is the second biggest cause for concern pinpointed by fund managers in the BoA survey.

Fully 35% of those polled saw a “taper tantrum” among investors as the next biggest risk to markets. This is the term which describes a sell-off in US Treasuries inspired by the Fed withdrawing monetary stimulus.

The phenomenon was first seen in 2013 when, in response to signals that the US economy had fully recovered from the financial crisis, the Fed – then chaired by Ben Bernanke – indicated it would withdraw QE.

US Treasuries sold off aggressively, the US dollar rose and stock markets in emerging economies such as Brazil, South Africa, Turkey and Indonesia, all of which have large amounts of dollar-denominated debt, fell sharply as overseas investors withdrew their capital.

In the event, the Fed did not actually taper its bond purchases but instead, launched another round of QE. Such tantrums, or the threat of them, have made it extremely difficult for the Fed to withdraw monetary stimulus.

Yet the current price of US Treasuries does not appear to be causing investors too much concern. Asked what level the yield on 10-year US Treasuries would have to reach to spark a 10% correction in stocks, some 43% of those responding said 2%, suggesting we are not there yet. But it is worth watching this particular security closely in coming weeks and months.

The other main takeaway from the BoA survey is that, notwithstanding volatility in US Treasuries, fund managers remain incredibly bullish about stock markets.

Some 48% of investors believe the global economy is enjoying a so-called “V-shaped” recovery, in other words a straight bounce-back from the pandemic, up from just 10% who expected such an outcome in May last year.

Fund managers expect the strength of that recovery to result in stronger company profits. A net 89% of fund managers surveyed expect company profits to grow – an even greater percentage than in February 2002, when the US recession sparked by the end of the dot-com boom and the 9/11 terror attacks was coming to an end or in December 2009, when it became clear that the global economy had pulled clear of the recession sparked by the global financial crisis.

Interestingly, a majority of those investors polled by BoA – some 52% – would prefer to see companies recycling those profits into their business by raising capital expenditure, rather than by returning it to shareholders via dividends and share buy-backs.

And investors are backing that optimism. A net 20% of investors said they were adopting higher risk levels than usual.

As striking is the finding that, despite the stunning performance of US stock markets during the last 12 months, only 15% of investors regard the US as a bubble. Some 25% of those polled still think this the early stages of a bull market while 55% regard it as the late stage of a bull market. That may not apply to tech stocks, though, with being “long” of tech stocks regarded as the “most over-crowded” trade.

The survey also reveals that the so-called “great rotation”, with investors switching away from growth stocks like techs and into so-called “value” stocks (those stocks which appear to be trading at less than their inherent value) is well underway. Accordingly, investors have been switching from the tech sector towards industrial, banking and consumer discretionary stocks.

All of this suggests that investors are pretty positive about the outlook.

However, the recent strong run in stocks, particularly in the US, has pushed stocks to historically high levels.

The S&P 500, America’s broadest stock index, is currently trading at 22 times expected earnings for the next year – compared with a long-term average of 16 times. Other major stock indices, such as the Topix in Japan and the pan-European Stoxx 600 are similarly trading at a premium to their long term average.

That implies there is plenty of scope for disappointment if company earnings fail to come up to snuff.

There are also plenty of other indicators of irrational exuberance out there, whether that is the current mania for cryptocurrencies or the rush to launch Special Purpose Acquisition Companies (SPACs), otherwise known as so-called “blank cheque” companies.

It is an old investment stock market adage that markets climb a “wall of worry”.

There is certainly plenty of optimism right now among investors. There are also plenty of reasons to be worried.