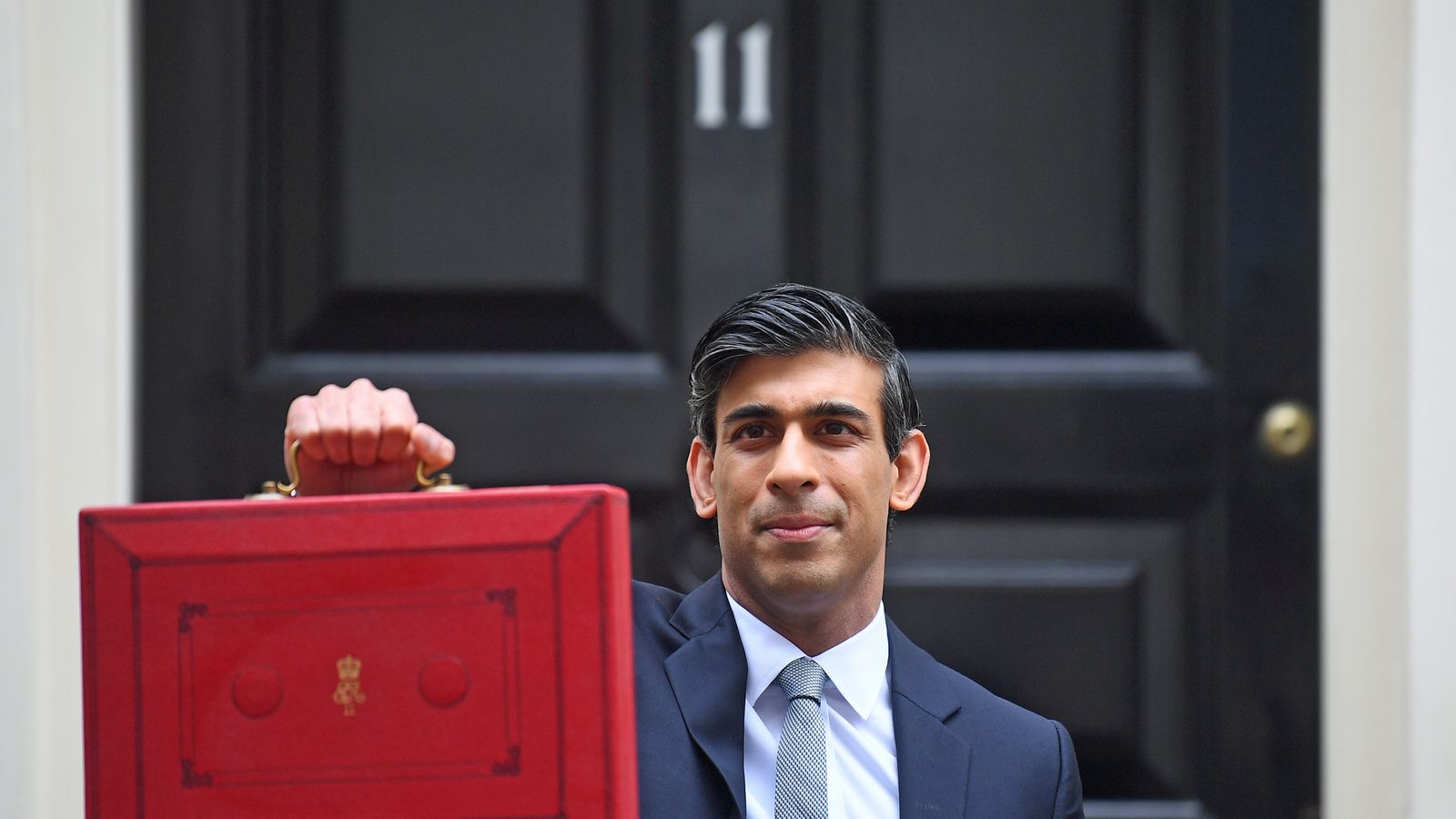

Chancellor Rishi Sunak has set out an extra £65bn in COVID support for employees and businesses – but announced a freeze on income tax thresholds and a rise in corporation tax to help pay back the UK’s rising debts.

In his budget speech, Mr Sunak set out a three-part plan to “protect jobs and livelihoods of the British people”.

But he warned that “corrective action” would be needed to tackle the UK’s rising debt, as he set out how the government was now committed to spending £407bn on coronavirus support.

Among his key measures, the chancellor announced:

The chancellor said the COVID crisis had caused “acute” damage to the UK economy and acknowledged it would take “this country – and the whole world – a long time to recover from this extraordinary economic situation”.

But he vowed: “We will recover”.

“I said I would do whatever it takes; I have done and I will do,” the chancellor said, as he reiterated his promise to support workers and businesses through the pandemic.

The chancellor said the government had borrowed a record £355bn this year, which he said was the “highest level of borrowing since World War Two”.

Having told MPs he wanted to be “honest” about his plans to begin fixing the public finances, Mr Sunak revealed part of his action will include an increase in the rate of corporation tax, paid on company profits, to 25% in 2023.

And the chancellor announced that personal tax thresholds will be frozen from next year until 2026, which has been described by some as a “stealth” rise in people’s tax bills as it will drag more people into paying extra.

But, in an eye-catching move, Mr Sunak unveiled a two-year “super deduction” scheme to allow companies to reduce their tax bill by 130% of the cost of new investments.

“Under the existing rules, a construction firm buying £10m of new equipment could reduce their taxable income, in the year they invest, by £2.6m,” the chancellor explained.

“With the ‘super deduction’, they can now reduce it by £13m. We’ve never tried this before in our country.”

Please use Chrome browser for a more accessible video player

Mr Sunak confirmed an extension of the furlough scheme until the end of September, with business being asked to contribute 10% of their furloughed employees’ wages in August and 20% in September.

The chancellor also set out the details of more support for the self-employed, including for those who missed out on initial government help.

And Mr Sunak announced the £20-a-week uplift in Universal Credit will continue for another six months.

In a package of support for businesses, the chancellor revealed:

Those buying houses will also enjoy an extension of the stamp duty holiday on purchases below £500,000 until the end of June, while Mr Sunak also confirmed a government guarantee on mortgages.

Setting out economic forecasts for the next few years, the chancellor said the Office for Budget Responsibility estimated the UK economy would grow by 4% this year and by 7.3% next year, before growing by 1.7%, 1.6% and 1.7% in the following three years.