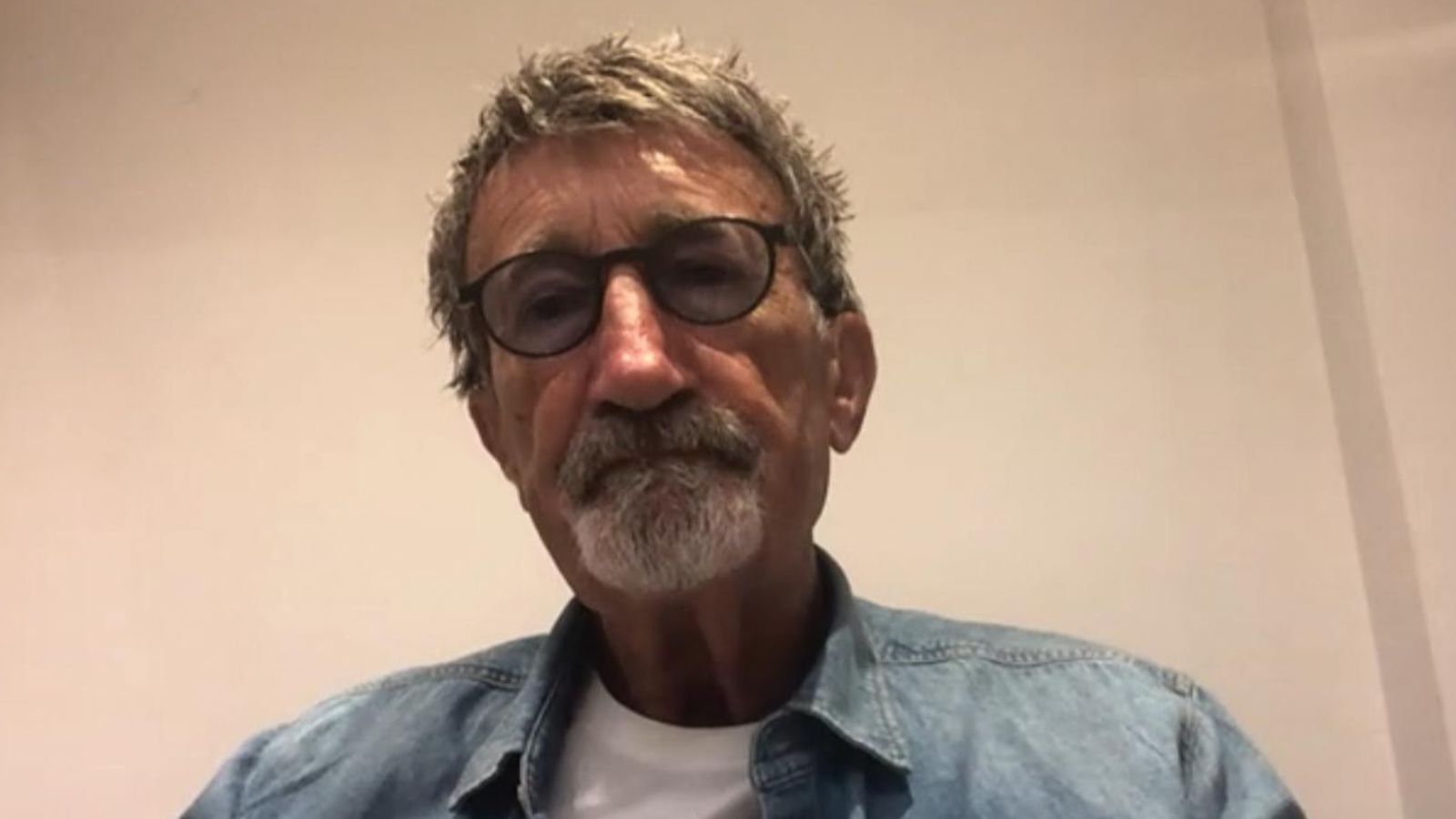

Eddie Jordan, the former Formula One (F1) team-owner, is part of a consortium plotting a £3bn-plus counterbid for Playtech, the gaming software provider at the centre of a bidding war.

Sky News has learnt that a firm founded by Mr Jordan is working with a US-based investor – thought to be Centerbridge Partners – on financing an offer for the London-listed company.

The consortium is said to have made a preliminary approach to Playtech’s advisers.

Its move will raise investors’ hopes of a full-blown takeover battle for Playtech, which has a market capitalisation of just over £2.2bn.

A source said that if it materialised, the consortium’s offer would be structured partly in cash and partly in contingent value rights (CVRs) based on the value of Playtech’s stake in a joint venture with Caliente, a gambling business which predominantly operates in Mexico.

Caliente and Playtech are holding talks about a separate process that could see the joint venture taken public through a merger with a special purpose acquisition company (SPAC).

Global Leisure Partners, a merchant banking boutique, is advising the consortium that includes Mr Jordan’s firm.

Inflation hits highest level in a decade at 4.2% as fuel and energy bills soar

Inflation: Why the Bank of England is set to raise rates when it can’t influence many rising costs

Amazon to stop accepting payments using UK-issued Visa credit cards

The Irishman’s involvement adds another layer of intrigue to a takeover contest which is fast-becoming one of the most hotly contested in the London market this year.

Mr Jordan sold his eponymous F1 team in 2005 and has since been involved in various businesses, as well as becoming a media pundit on the sport.

In recent months, he has established JKO Capital with Keith O’Loughlin, a former executive at Scientific Games, with the objective of identifying deal opportunities in the international gaming arena.

It was unclear on Wednesday night whether Mr Jordan’s consortium was certain to make a firm bid for Playtech, given the complexity of its proposed offer.

Playtech accepted a 680p-a-share bid from Aristocrat, an Australian company, last month.

It then confirmed a subsequent Sky News report that Gopher Investments, a vehicle which is already its second-biggest shareholder, was also evaluating a bid.

Gopher is working with bankers at Rothschild on an offer that would trump Aristocrat’s bid.

Under the terms of the Australian offer, a series of irrevocable undertakings it has secured from Playtech shareholders would lapse if any rival suitor offered a price at least 10% higher than its bid.

That implies Gopher or any other suitor would need to bid at least 748p-a-share to secure a board recommendation.

Playtech claims to be the world’s largest supplier of online gaming and sports betting software.

Gopher has become one of Playtech’s most prominent shareholders this year, waging a bitter fight to acquire its financial trading arm, Finalto, for $250m.

The Aristocrat offer for Playtech is conditional on the sale of Finalto to Gopher being completed.

According to documents published by Aristocrat in connection with its offer, negotiations relating to the separate US-listed business “remain subject to further negotiation involving multiple parties, financing and the satisfaction of certain other pre-conditions”.

The global gambling sector has seen a deluge of major corporate deals this year, including most notably in the UK the takeover of William Hill by Caesars Entertainment, with its British operations subsequently acquired by 888, the London-listed group.

More recently, DraftKings, a US-based gambling giant, abandoned plans to bid for Entain, the owner of Ladbrokes and Coral in the UK.

Spokespeople for JKO, Centerbridge and Playtech all declined to comment.

A person close to Centerbridge suggested it would not be involved in the equity component of any prospective offer.