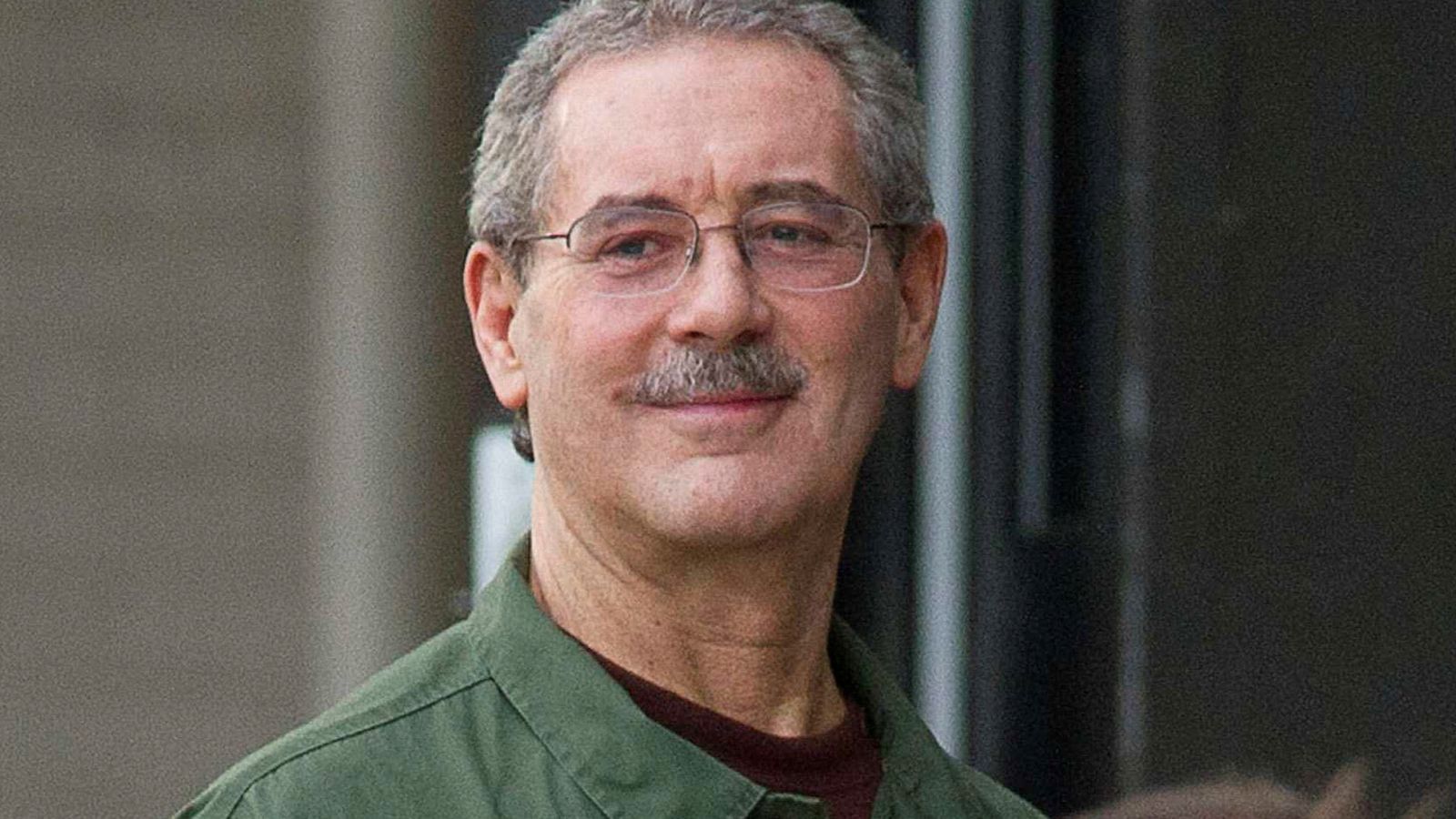

Efforts to compensate victims of Ponzi fraudster Allen Stanford have recouped more than $1bn, lawyers for a court-appointed receiver have revealed.

The milestone was hailed as a “significant achievement” – 12 years after the Texan former tycoon’s scam was exposed.

Stanford, 71, is serving a 110-year prison sentence after his conviction in 2012 for running a $7.2bn Ponzi scheme affecting around 18,000 investors.

Prosecutors said Stanford sold fraudulent high-yielding certificates of deposit through his Antigua-based Stanford International Bank.

He used investors’ money to make risky investments and fund a lavish lifestyle.

The fraud which was uncovered in February 2009, had lasted about 20 years.

In a Ponzi scheme, a company attracts investors with the promise of big returns but instead of using their money in a legitimate transaction, channels it into returns for earlier investors.

One in four UK households exposed to vulnerable ‘unhedged’ suppliers

Energy price cap to stay, business secretary declares after crisis talks over gas price hike

COVID-19: US to relax travel rules for vaccinated passengers from UK and EU

Such a scam relies on a continuous flow of new investments – and falls apart when they stop.

Ralph Janvey, the receiver for Stanford Financial Group, has been trying to recoup money for investors since 2009.

Kevin Sadler, a partner at law firm Baker Botts representing Mr Janvey, said in an interview: “When the receivership started, the receiver found only $63m in a bank that was supposed to be holding more than $7bn

“It has taken more than 12 years, but getting to $1bn is a significant achievement.”

The threshold was crossed when $65m was received from a June 2016 settlement with insurers including Lloyd’s of London, which won final court approval in January after years of legal wrangling.

Mr Janvey expects to distribute money from the settlement in the first quarter of next year.

As of 29 April, he had received court approval to return about $550m to victims, and had distributed $443m.

Mr Janvey is involved in litigation over further attempts to recover money including a $4bn lawsuit against five banks, among them HSBC and Societe Generale.

The money he has recouped so far is the largest such effort other than that set up in the wake of the uncovering of another fraudster, Bernie Madoff – which has clawed back $18bn for victims.

Madoff died in April, at the age of 82, while serving a 150-year prison term. His fraud was discovered in December 2008.