Wages are rising less than expected and unemployment surprisingly rose, official figures show – but likely not fast enough for interest rates to come down.

The rate of unemployment tipped up slightly to 3.9% in January, when it had been forecast by economists to remain at 3.8%.

Money blog: Six £1m lottery prizes unclaimed – here’s where they were bought

Pay growth has also slowed more quickly than expected.

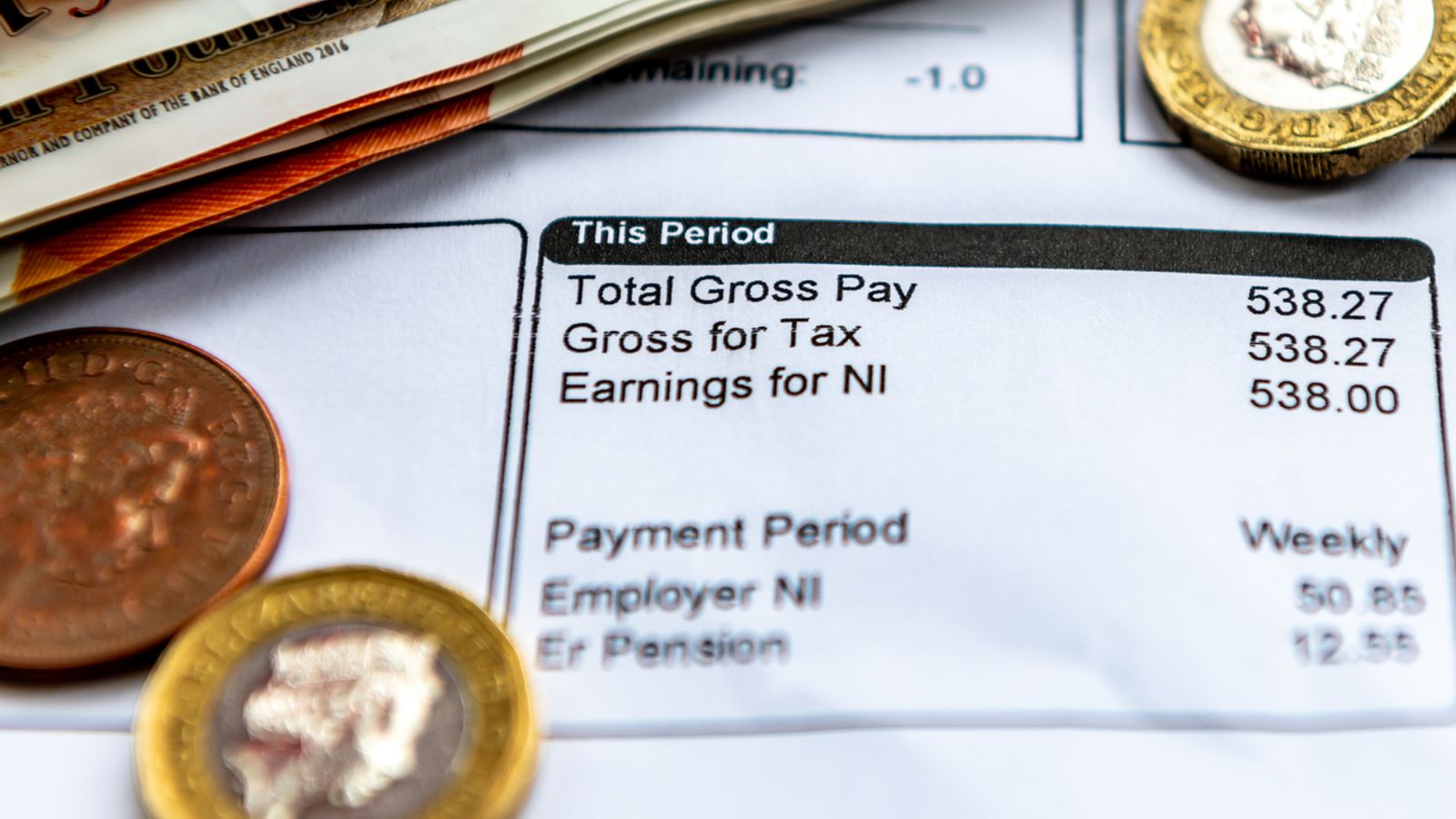

When bonuses are factored in, pay packets grew 5.6%, lower than the 5.7% rise expected by economists polled by Reuters, and regular pay – not including bonuses – ticked up to 6.1%, when growth of 6.2% had been forecast.

It’s the lowest rate of growth in more than a year – not since October 2022 have wage rises been at such a level – but still above the overall rate of price rises, which stood at 4% in the year to January.

But the Office for National Statistics (ONS) has warned against reading too much into its own figures.

Budget 2024: All income groups bar richest 10% better off this year due to government tax and benefit policies

How Budget 2024 had a smaller impact on public finances than the autumn statement

Ed Conway and Beth Rigby: Was that a budget for a May election?

The body last month again revised its assessment of the labour market, saying the UK unemployment rate may have been much lower, near historic lows at 3.9%, rather than the 4.2% estimated at the end of 2023.

A picture of a tightening labour market, with fewer jobs on offer, more unemployment and lower wage growth has been painted by the figures.

Wage growth had been higher in December: 6.2% excluding and 5.8% including bonuses.

The number of job vacancies fell for the 20th time in a row – by 43,000 openings – but still remain above pandemic levels.

It’s unlikely to be enough to encourage the Bank of England to bring down the cost of borrowing, via interest rates, at its next rate-setting meeting next week or in May.

Rates will be reduced in June, investors are betting. Previously markets had been pricing in a May rate cut which is now looking unlikely and subsequently caused mortgage rates to rise again.

Be the first to get Breaking News

Install the Sky News app for free

Chancellor Jeremy Hunt said: “Our plan is working.

“Even with inflation falling, real wages have risen for the seventh month in a row. And take home pay is set for another boost thanks to our cuts to National Insurance which in total are putting over £900 a year back into the average earner’s pocket.”