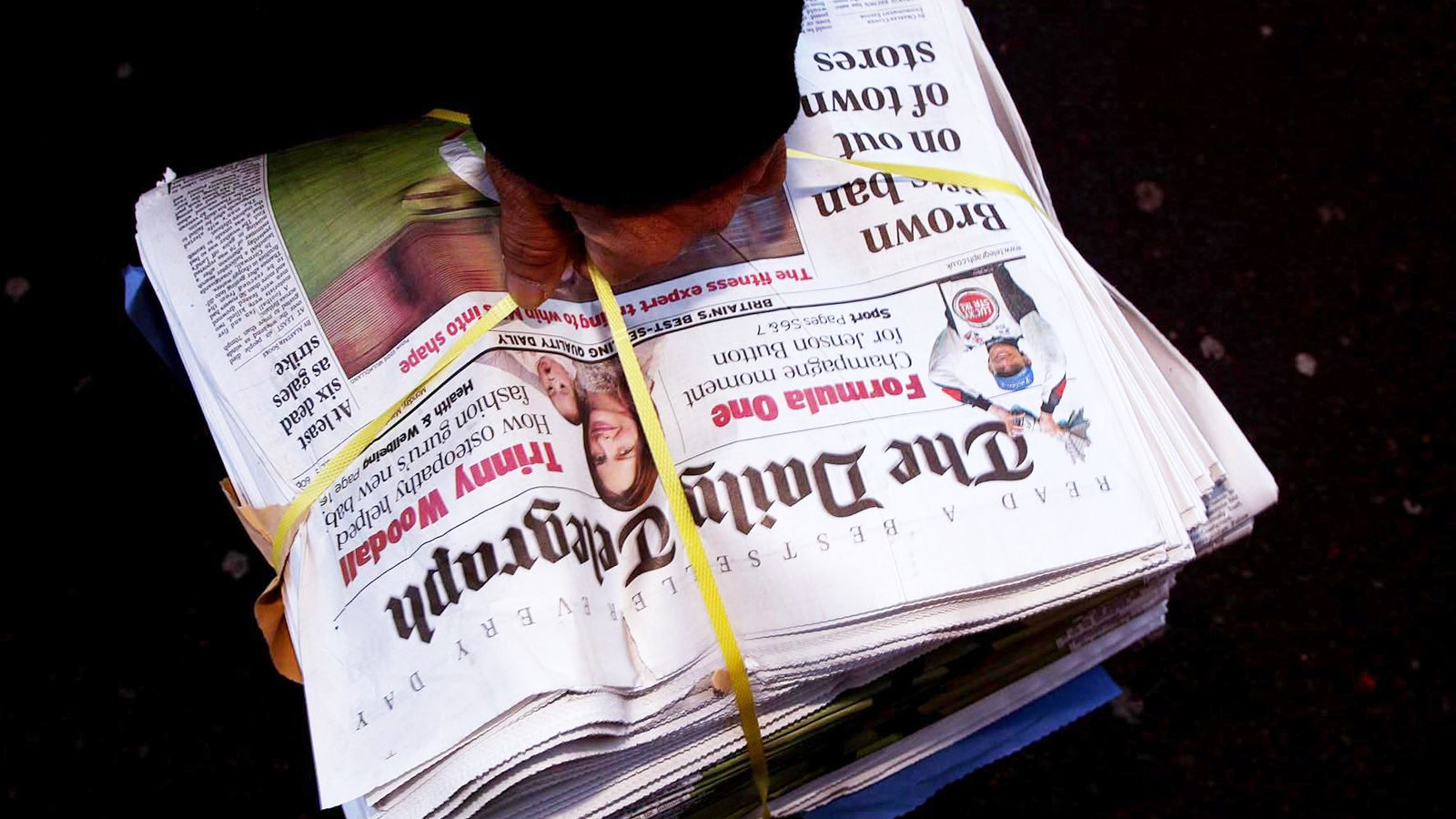

Sir Paul Marshall, the hedge fund tycoon, has enlisted investment bankers to aid a prospective bid for The Daily Telegraph.

Sky News has learnt that Sir Paul, the co-founder of Marshall Wace and a big shareholder in the right-wing television news service GB News, has hired Moelis to advise him on the newspaper’s impending auction.

Sources close to Sir Paul, who also owns the political commentary platform UnHerd, said he had not yet made a firm decision about whether he would bid for the Daily and Sunday Telegraph titles alone, or whether he also planned to make an offer for The Spectator, the current affairs magazine.

The three prominent media assets have been put up for sale after Lloyds Banking Group seized control of them from the Barclay family, their long-standing owners.

Sir Paul has been widely rumoured to be interested in bidding, though the fact that he has hired bankers to advise him underlines the degree of seriousness he is attaching to the situation.

He has an estimated fortune of £800m, according to The Sunday Times Rich List, based on his enormous success during a long career in the hedge fund industry.

His appointment of advisers comes as bidders jockey for position ahead of a formal auction getting under way.

Pace of wage growth outstrips rate of inflation while unemployment rate ticks up

Why the end to interest rate hikes is now in sight

Wilko stores start closing for good on Tuesday as family-owned retailer prepares to shut down

Sky News revealed last month that the Barclay family was lining up hundreds of millions of pounds from Middle Eastern investors in a bid to wrest back control of the newspapers from Lloyds.

The family has lodged a series of proposals to buy back roughly £1bn of debt it owes Lloyds Banking Group.

Sky News also revealed last month that Lord Rothermere, the Daily Mail proprietor, was talking to Gulf-based investors about backing an offer for the Telegraph titles.

A formal sale process, run by the Wall Street bank Goldman Sachs, is expected to kick off later this autumn.

The Barclay family’s latest offer underlines, however, its determination not to permanently lose control of the media group it took control of in 2004.

Lloyds had been locked in talks with the Barclays for years about refinancing loans made to them by HBOS prior to that bank’s rescue during the 2008 banking crisis.

Until June, the newspapers were chaired by Aidan Barclay – the nephew of Sir Frederick Barclay, the octogenarian who along with late brother Sir David engineered the takeover of the Telegraph 19 years ago.

Be the first to get Breaking News

Install the Sky News app for free

A source said this weekend that the Barclays were adamant that their proposal to buy back the Lloyds debt offered the bank a “clean” solution that would avert any regulatory probe that might be triggered by another media group buying the Telegraph.

A sale for £600m, or anywhere close to it, would trigger a substantial writeback for Lloyds, which wrote down the value of its loans to the Barclays several years ago.

Nevertheless, a deal financed entirely by overseas investors could trigger other concerns relating to media ownership, particularly with the traditionally Conservative-supporting Telegraph titles being sold in the year before a general election.

Charlie Nunn, Lloyds’ chief executive, said during the summer that he saw no need to run “a rushed sale process”.

Other potential suitors for the Telegraph titles include National World, the regional newspaper publisher headed by David Montgomery, the industry veteran.

Read more from business:

Pace of wage growth outstrips rate of inflation

Grocery price inflation now at lowest level for more than a year

In July, Telegraph Media Group (TMG) published full-year results showing pre-tax profits had risen by a third to about £39m in 2022.

A successful digital subscriptions strategy and “continued strong cost management” were cited as reasons for the company’s earnings growth.

“Our vision is to reach more paying readers than at any other time in our history, and we are firmly on track to achieve our one million subscriptions target in 2023 ahead of our year-end target,” said Nick Hugh, TMG chief executive.

The sale will be overseen by a new crop of directors led by Mike McTighe, the boardroom veteran who chairs Openreach and IG Group, the financial trading firm.

Mr McTighe was recently named as chairman of Press Acquisitions and May Corporation, the respective parent companies of TMG and The Spectator (1828), which publish the media titles.

On Tuesday, a spokesman for Sir Paul declined to comment.